28 Feb Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of March 1st 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

-

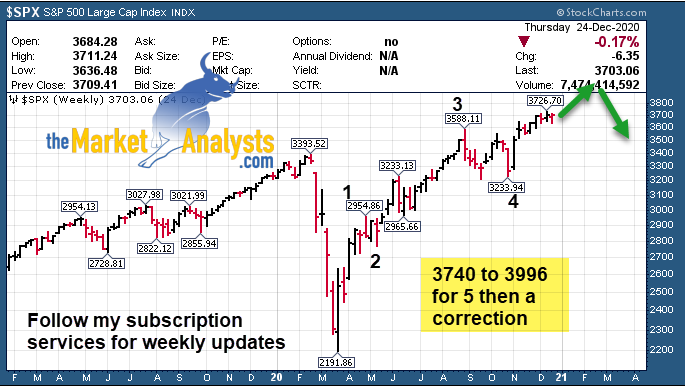

- SP 500 tops out at 3950 area, 46 points shy of my 3996 long term target for Wave 5

- Should be correcting to 3500-3550 in the weeks ahead possibly, watch 3710 support on SP 500 in meantime

- Bitcoin tops out around 58,000, watch 41,000 for support as noted last week we sold 1/3 MARA at 46

- Bulls at 56% in latest Advisor survey, finally starting to come down from 68% highs this year (Sentiment)

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- SRP ends week at 100% in cash as we lay low near term, took profits early in week on a few trades and a loss on SWAV of about 7% late in the week

- 3x ETF service is layering into a 1x ETF right now but otherwise cash for now

- TPS stocks we bought right, sitting tight or will advise on adding in March to some positions, we took lots of profits over last several weeks in some names and or closed another out this past week for gains

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

2/28 Update:

Market volatility is picking up which I discussed at SRP over last few weeks as likely. March should be a whipsaw, long term I remain bullish on the markets. We need a correction and it will work off extremes in sentiment etc. I use them to build positions in businesses that I think are undervalued or materially mis-priced by the market. A few of note near term are PLX in the Biotech sector which as a PDUFA FDA date of April 27th, amazing data that just came out into a rough Biotech market this past week. Good one to accumulate for long term investors, I am building a position.

My point being, I welcome corrections in terms of building my wealth portfolio. I’m happy to add to long term positions by scaling in on big drops.

As far as my income planning, thats SRP swing trading, and I simply slow down or keep higher cash allocation until I get closer to an all clear sign. We are 100% in cash going into Monday after closing out the last few positions this week, a few for profits and two for losses. We did this last February into March with 80-90% cash ratios during most of the Covid crash, and then started going back in heavy on March 23rd. This time around, I’m watching 3711 and then 3550 as likely pullback support areas on SP 500.

Charts This week: SP 500 weekly

Chart from Dec 27th Report repeated for reference: This was my projection back in late Oct 2020

Limited to roughly 200 or so members max, allowing a few extra in

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving.

Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined

Rough market last week, or at least volatile. ETSY off the weekly list soared late in the week on blowout earnings.

INMD- 4 weeks tight base near highs. Israeli seller of radio frequency devices used in minimally &

non-invasive cosmetic procedures/women’s health.

PINS- 4 weeks tight closing base near highs. Provides a visual discovery platform that helps users to discover ideas

for various projects and interests (Pinterest)

MU- 8 week base near highs . Makes DRAM, NAND and NOR Flash memory, and image sensors used in computers, servers and consumer electronics

HOME- 5 weeks tight base near highs. Operates 212 home decor stores across 39 states , averaging

about 105,000 sq.ft per store.

TTGT- 3 week corrective pullback towards 10 week line. IT network advertising via large net work of websites

QFIN- Pulling back towards 10 week EMA line, a good buy at 20-21. Chinese data driven tech platform helps financial companies attrack/advertise to customers

SCPL- Big pullback, develops and designs digital games for mobile platforms

DT- Nice pullback 3 week corrective base pulling back towards 10 week EMA line. Software intelligence platform for IT

PLT- 4 week corrective base towards 10 week EMA line, headphones/headsets for tele workers

CMBM- 5 week ascending base near highs. Wireless infrastructure provider

MRVI- 15 week post IPO base, pulling back towards 10 week EMA line. Provides products to help develop drugs, vaccines etc.

LOVE- 6 weeks tight base near highs. Manufactures and sell foam filled furniture, sectionals etc.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 7 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! ATOM up over 300%!, INMB up 172%, just a few of the recent big winners! Fresh ideas every month.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)