31 Jan Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of February 1st 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

- SP 500 Major 5 appears to have topped at 3870, 3475 is my new target for now (Chart)

- Put to Call ratio as noted last Sunday in this report was Bearish for the market

- SRP is 90% in cash going into Monday in our Swing Trade Model

- 3x ETF is long TZA (3x Bear small caps as of mid last week)

- Correction should be around 10% off the highs, market will need to rally hard Monday to reverse trend

- Individual Stocks can still move to the upside during the correction, but best to tread carefully is all

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- SRP Swing Trade Stocks Profits taken, losses on 3 stocks, 90% cash at end of week

- 3x ETF- Cashed out LABU for 16% profit near top, Entered TZA as bear hedge play

- ES Futures- 3750 stop triggered late in week

- TPS- Closed out a TPS play for 80-100% gains, raising cash, setting up spots to buy/add on dips

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

From 1/24 Weekly Report Notes last week:

“As noted here last week, gut says we are getting closer to that top. We have put to call ratios at historical lows, sentiment readings at historic highs, non profitable tech stocks (NASDAQ) at relative historical highs to profitable companies, and a Major 5 nearing a typical length high or close. Its good to be on guard.”

Also from the Put to Call chart last weekend I noted:

“Weekly put to call ratio near 52 week lows and multi year lows, typically comes near the top of a 5th wave bull cycle”

Updated Notes:

So we got hit with the avalanche of selling on Wednesday and I had tight stops in place on purpose. We sold out of 3 positions for reasonable losses, and then a break even on Thursday. We have just 1 position left long and that rebounded up on Friday after earnings. I can still find stocks to trade but this is where I slow down and follow the SP 500 action and try to be patient. If for some reason we rapidly rebound early this coming week, we can shift but for now watching for possible drop to 3475 on SP 500 for starters over next few weeks. Mercury also went Retrograde on Saturday, Full Moon last Thursday and those add to a topping recipe is all.

Charts This week: SP 500 Daily and Dec 27th Weekend Report long term chart repeated

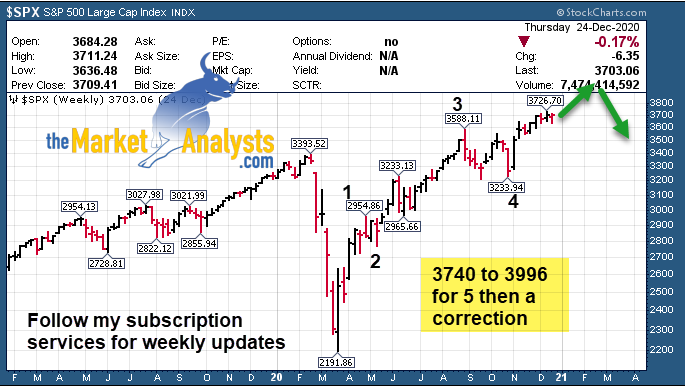

Chart from Dec 27th Report repeated for reference: This was my projection 4 weeks ago

Limited to roughly 200 members max, taking final members now in January as we are over 200

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. Among recent and ongoing winners ATOM, INMB and more!

Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

YALA the big winner off the list last week. Alerted it Monday at SRP but it blasted off fast and hard to get in.

Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined

LOGI- 4 weeks tight base near highs, tested 10 week line on pullback this past week. Strong earnings report, computer peripherals maker, 2nd week in row on list

HZO- 3 week tight near highs, 2nd week in a row on the list, near a 5 month overall breakout. 77 Retail stores in 21 states selling new and used boats, pleasure and fishing etc.

QFIN- 5 week overall ascending base, 2nd week in row on list, went up again last week and near a 7 month overall breakout. Chinese provider of digital consumer finance platform and consumer financing services.

CHGG- 5 weeks tight base near highs for online education tools provider, 2nd week in row on list, moved up a bit last week but still looks bullish. 4th week in row on list, we did get stopped out last week at SRP on tight stop

VIRT- Potential 5 month breakout for securities and financial instruments quotation provider

PCRX- 3 week corrective pattern after a breakout. Develops specialty pharmaceuticals

SWKS- 4 Week ascending base pulls back from breakout late in week. Analog Mixed Signal IC’s.

TBIO- Former TPS play we cashed out of weeks back for gains, but now setting up in nice base. Develops therapeutics for treatment of diseases caused by gene or protein dysfunction.

SDGR- 4 week base near highs and 7 month overall cup pattern. Develops software that enables drug discovery of novel molecules and materials applications (A.I. play)

XPEL- 6 week ascending bullish base at or near 52 week highs, 2nd week in a row on list. Manufactures and distributes after market automotive products in U.S, Canada, U.K and Netherlands. A bit extended so tight stop if you play.

HOLX- 9 week base, broke out 3 weeks ago but pulled back a bit last two weeks to 10 week EMA Line. Develops imaging systems and diagnostic and surgical products focused on the healthcare needs of women. SRP is long.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 7 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! ATOM up over 300%!, INMB up 172%, just a few of the recent big winners! Fresh ideas every month.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)