19 Jul Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of July 20th

“Your calls are very good! Nice work! You are calm, collected and cool in this Volatile Market. I appreciate your excellent work…just evaluate, execute and leave each day behind for tomorrow’s action; which is extremely difficult to do! I am learning…under your clear and simple instructions.(I have a hard time trusting when money is concerned! LOL!!)Thank you!!” 7/9/20 -@sproutup1 on Stocktwits (3x ETF service)

Notes:

- SP 500 continues to set up to breakout with 3450 interim target

- Biotech continues to lead as projected after pullback early last week

- 3x ETF service still long SPXL (SP 500 at 3x leverage ETF)

- Futures service long on ES (SP 500)

- Trading Base patterns for Swing Gains notes

- Fresh list of swing trades at bottom of report, updates on last weeks list

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- Stocks- Riding several open positions in base patterns, with new alert on VUZI Thursday

- 3x ETF- Long SPXL from 43.50-44 in 3x ETF service (3x Bull SP 500)

- ES Futures- Long currently on ES looking for potentially large swing up

- TPS- VIR leading gainers of late in TPS Portfolio, we look for 50-200% movers

Swing Trading and Momentum Stock Services:

Stock Swing Trading, 3x ETF Bull and Bear Swing Trading, E MINI/Micro-MINI Futures Trading, Momentum Growth Stock investing

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! 80% success rate since inception! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance Tax Favorable trading. See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,500 per contract roughly for members who are too busy to handle alerts and trading on their own. Track Record on fire since Late April change to Micro-Mini’s.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent sample VIR! Join and add momo growth stock plays to your swing trading! Use Coupon SAVE25 to save 25%.

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Market Commentary

We continue to see SP 500 setting up in a 5 day base near prior 3235 highs resistance and ready to break out. I am positioning members in various services accordingly with appropriate stops in place. Intermediately I can see 3450 area as likely, which requires a 6% move up and past 2020 highs to get there. With August-October window coming up we could have some resistance but ultimately we move over 3450 on way to 3800 by year end, as my general outlook.

Also Biotech as I’ve been saying for a few months continues to lead and will do so through 2021 likely as a leading sector after a few years of consolidation. An XBI ETF target of 121 I put out several weeks ago looks close to hitting.

Small caps are getting love this spring/summer which is nice after a few Bear cycles the last few calendar years. This has put tailwinds behind my Tipping Point Stocks portfolio and subscription service. Some great recent plays there include VIR from 30 now 52 as a likely emerging Biotech leader in my opinion. OTRK also in the E Health space has almost doubled from 11 months ago buy report in TPS service. There are several others including ATOM from under 7 now looking poised to double or more from $10 area.

Consider joining for momentum growth stock investing to add to your Swing Trading on 3x ETF, Stocks, and Futures services Other recent closed out plays include DYAI and PRVB for nice 50-60% gains READ UP

In summary the market looks poised to move to the upside here. Looking at the SP 500 we have a recent 5 day consolidation and a broadening of breadth in various sectors participating. The recent ABC Truncated pattern was a clue in my book to get more bullish as the C wave correction was a higher low than the A wave (See chart).

SP 500 updated Chart: Noting the obvious 3233 resistance, watching 3173 as short term support.

Other Trading and Market Related Sentiment Notes from Dave:

Attack Capital and Behavioral Patterns: Have a plan and prepare to POUNCE!

One of the keys to both swing trading and long term growth stock success is spotting those normal consolidation or pullback patterns as they are transpiring. Often traders get shaken out of great potential swing up positions on a sharp pullback or they lose patience on consolidations. I have always said “Stocks make their biggest percentage moves in very short time frames, you must be positioned ahead of the move”. In English this means in my swing trader services my 70% plus success rate over 11 years of work in all cycles is due to the combination of Fundamental analysis of a business along with a “Behavioral pattern” chart analysis.

I try to combine the two so that the chart pattern from a human emotional pattern perspective is telling me to get long a stock along with solid or improving fundamentals. Sometimes though we put out a swing trade and the stock wont move for 4 or 5 weeks, it’s tempting to give up and close the position. However, often these positions move sharply if you lose patience and you give up those gains. I look for multiple week base patterns where I think traders are losing patience and that the position is poised for fundamental and pattern reasons to break out of a range. I try to have my members get into those swing positions just before the move, so that we are buying correctly and minimizing our risk while keeping our upside high.

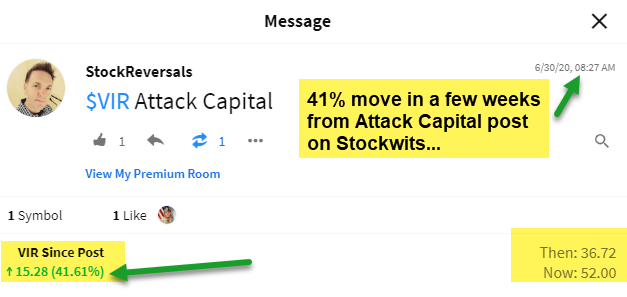

Sometimes I call this “Attack Capital” which means a stock has pulled back sharply for mostly behavioral pattern reasons and its time to push money in aggressively before the turn or a breakout.

A good recent sample was VIR which is in my Tipping Point Stock service. The stock ran to 50, then in a few days on no news dropped to 36-37 area. Some said it was due to an insider selling at 50, but turned out we found out later they were planning a secondary stock offering and that ended up going off at $42. Once that news hit, the stock actually was already running and now stands near $52.

A nice 41% move attacking with Capital on that pullback from 50 to 37 area. Make sure to follow me on stocktwits in addition to my services as sometimes stocks move fast and I may have an “Attack Capital” post.

When I look for Swing Trade opportunities, sometimes they move so fast that I can’t type up an alert fast enough for my members, so I’ll post it on Stocktwits. At any rate, many of our SRP swing trades and even 3x ETF swing trade entries are based on buying into short term oversold pullbacks that are over reactions or behavioral based and or base pattern consolidations ready to pop. When you review the Sunday Swing Trading ideas section, many of these are setting up in base patterns.

Have an attack capital plan with your watch list of solid companies and when you see that base pattern or pullback setting up, do not be afraid to pull the trigger. While everyone is selling and in a short term stop loss panic, we buy and profit. Our risk is lower, and returns are higher!

Consider joining my subscription services at TheMarketAnalysts.Com for tradeable ideas and updates daily, 3x ETF, SP 500 Futures, Stock Swing Trading and Long Term Growth stocks (CRBP one example)

If not you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Repeated from Last week: (Consolidating or did not yet break out)

DT- 5 Week base base near highs, 4th week in a row on list. Security solutions provider for enterprises

GO- 2 weeks tight base near highs, 12 month Post IPO right side base possible breakout soon. Discount Stores growing rapidly. 2nd week in a row on list.

NBIX- 6 weeks tight base near highs, 2nd week on list

New Ideas:

CHGG- 3 week base near highs- Online education tools provider, SRP position 1/2 open still

AMD- 14 week base near highs- Leading chip maker

SFM- 11 week base near highs- Sprout Farmers Market, play on organic foods etc.

BMY- 10 week corrective base moving up now on right side. Emerging blue chip that bought Celgene last year

PETS- 11 week tight- Pet store chain

VIRT- 3 week ascending pattern out of flat base- Financial quoting services for broker/dealers

HUYA- 2 weeks tight near highs- Chinese Online games

NARI- Post IPO near highs – Recent IPO in Venous Disease area

IPHI- 11 week base near highs , Servers and Routers infrastructure provider

DRD- 4 weeks tight base near highs for African Gold producer/explorer.

AMRC- 4 weeks tight base near highs, energy infrastructure.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! CRBP recent huge winner! Fresh ideas every month.

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

ESAlerts.com- Auto Trading of Micro MINI contracts, $1,500 roughly per position size. $5 move for each 1 point SP 500 move. Trades executed on your behalf based on our Advisory automatically. For those too busy to follow alerts and trade on their own. TRACK RECORD ONLINE

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)