13 Sep Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of September 14th

“Your calls are very good! Nice work! You are calm, collected and cool in this Volatile Market. I appreciate your excellent work…just evaluate, execute and leave each day behind for tomorrow’s action; which is extremely difficult to do! I am learning…under your clear and simple instructions.(I have a hard time trusting when money is concerned! LOL!!)Thank you!!” 7/9/20 -@sproutup1 on Stocktwits (3x ETF service)

Notes:

- SP 500 wave 4 continues, 3295 key pivot level to watch

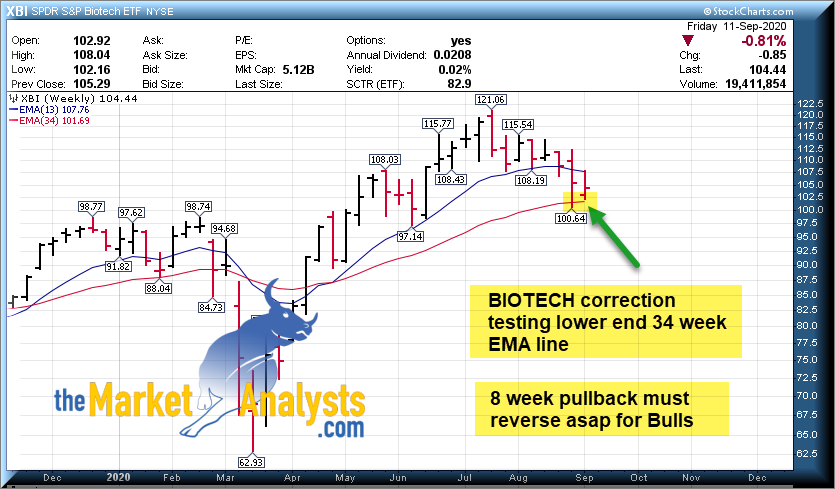

- Biotech (XBI ETF) in 8 week correction, testing 34 week EMA line, needs to rally up soon

- GDX ETF charted, looks poised to break out if we get a move up in Gold

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- Stocks- New positions added late in week after being patient during correction

- 3x ETF- Still long two positions coming into this week in base patterns

- ES Futures- Got washed out of a long trade for a loss

- TPS- TFFP (Up 135%) still looking very strong, INMB could be next stock to move

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Market Commentary

Last weeks comment:

“After a powerful “3rd of a 3rd” the next 4th wave correction will often be harsh and quick in terms of price action. This is what we saw with a near 7% drop from top to bottom in 2 trading days and a bounce on Friday off the 3349 lows. We could revisit those lows again for a re-test or possible have slightly deeper drop to 3265-3300 area as well. “

Updated Notes: We held 3300 area so far

SP 500 needs to hold this 3300 area loosely to be termed a normal correction for a Wave 4 label I have put on this chart this weekend. With the Election around the corner, end of September quarter end and October Fiscal Year end after that it should be volatile in a range. Ultimately the idea is the 5th wave shows up and takes us to 3800 plus all time highs, but one would expect some heavy sledding to get there. See my updated daily and weekly SP 500 charts.

SP 500 updated Daily and Weekly chart views:

Gold Update: 2300 intermediate target after consolidation GDX ETF chart noted here

GDX in 8 week bullish base (NUGT could be a play here)

Biotech: Needs to hold 100 area, in 8 week corrective base testing 34 week EMA

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. We closed out several for 60% plus gains lately to make room for new positions. Among them VIR, ATOM, TFFP, OTRK naming a few big winners for members.

Most recent research was TFFP at $5.83 several weeks ago, now up over 133% on their Thin Film Freezing technology for the delivery of drugs/vaccines. Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Ideas: Several Gold stocks look bullish…

KL- 7 week base testing 10 week line, Gold producer

MRVL- 10 week base just above 10 week line. Chip play

DOYU- 6 week overall base near highs, New SRP Re-entry position after pullback, looks bullish still. Chinese online gaming

APPS- 6 week overall base, pulling back now to test 10 week line (Mobile software apps etc)

TENB- 4 week corrective pattern, pulling back off highs, on our list recently. Cyber Security Platform

VIRT- 2 weeks tight base near highs, we took profits at SRP but this looks very strong still

GRBK- Near highs, 6 week tight flat base, Land Developer and Home builder

SBSW- 7 Weeks tight base near highs, Gold producer

PVG- 6 weeks tight base near highs, Gold producer

FVRR- 6 weeks tight base near highs, outsourced digital workers

IIPR- 6 weeks tight base near highs, Real Estate REIT mostly for Cannabis growing properties

GOLD- 8 week base near highs, Barrick Gold

SAIL- 6 week base, test of 10 week line, Identity Software

RKT- Post IPO pullback after a surge up for Rocket Mortgage

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

Read up on my various offerings to take advantage of Bull and Bear cycles at TheMarketanalysts.com

Swing Trading and Momentum Stock Services:

Stock Swing Trading, 3x ETF Bull and Bear Swing Trading, E MINI/Micro-MINI Futures Trading, Momentum Growth Stock investing

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! 80% success rate since inception! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance Tax Favorable trading. See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,500 per contract roughly for members who are too busy to handle alerts and trading on their own. Track Record on fire since Late April change to Micro-Mini’s.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent sample TFFP up 120% in 8 weeks! Join and add momo growth stock plays to your swing trading! Use Coupon SAVE25 to save 25%.

Contact Dave with any questions (Dave@themarketanalysts.com)