27 Sep Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of September 28th

“Your calls are very good! Nice work! You are calm, collected and cool in this Volatile Market. I appreciate your excellent work…just evaluate, execute and leave each day behind for tomorrow’s action; which is extremely difficult to do! I am learning…under your clear and simple instructions.(I have a hard time trusting when money is concerned! LOL!!)Thank you!!” 7/9/20 -@sproutup1 on Stocktwits (3x ETF service)

Notes:

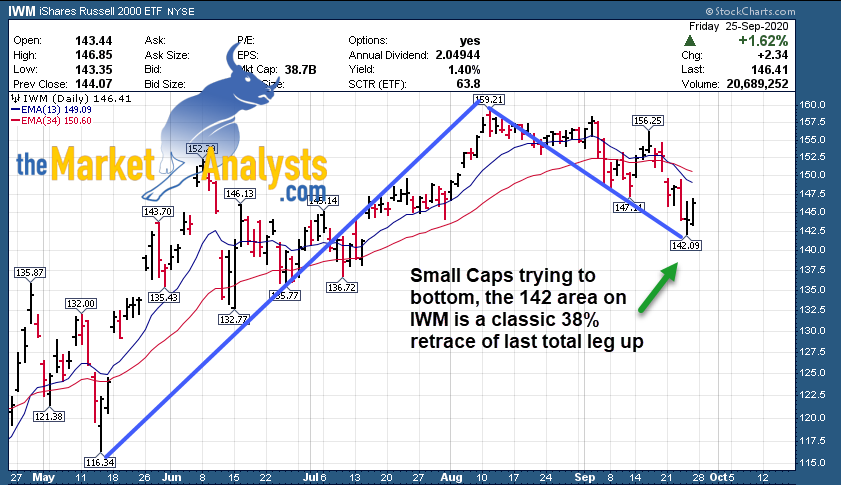

- SP 500 may have Zig Zag bottomed this past week (Chart)

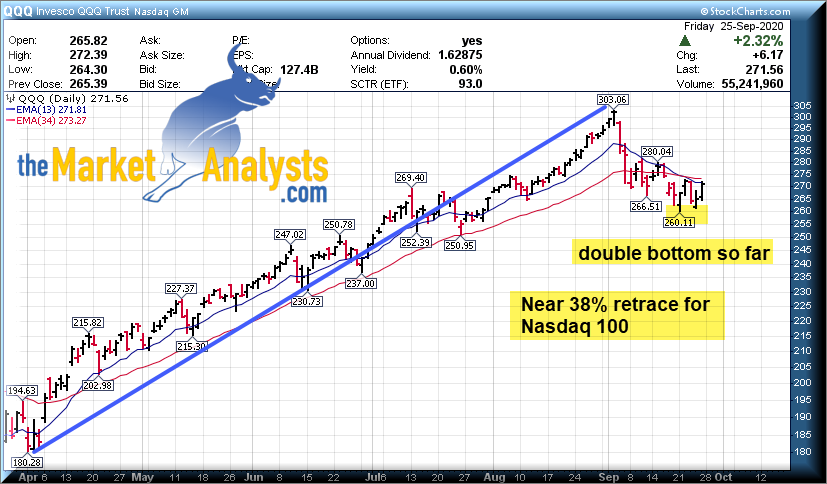

- NAS 100 possible double bottom with near 38% retracement hit of last Bull leg up (Chart)

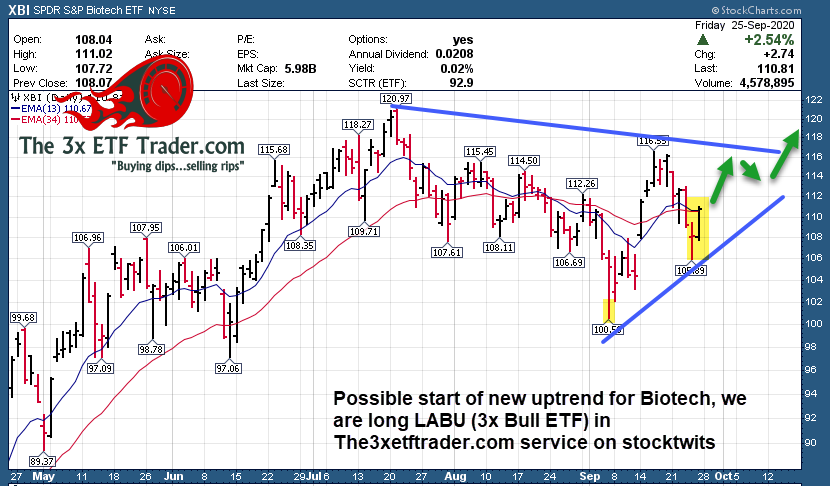

- Biotech (XBI ETF) also looks like bottom is in, we are long LABU 3x ETF in 3xETF service (Chart)

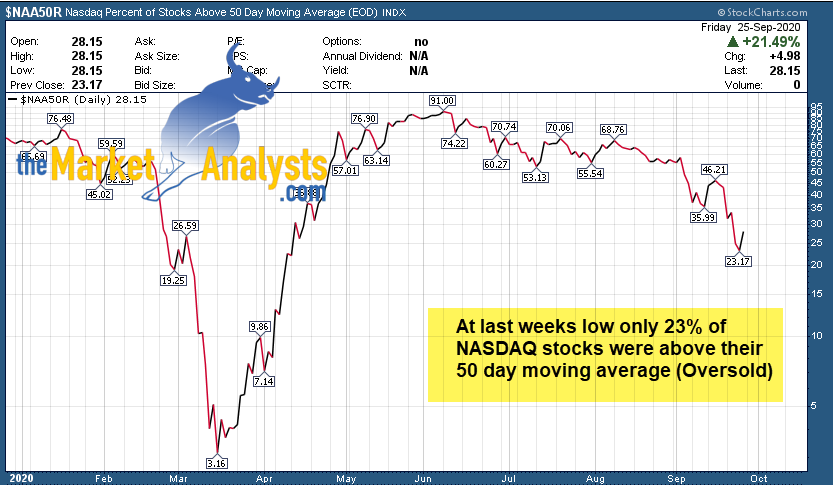

- % of NASDAQ stocks above 50 day EMA line dropped to 23% at last weeks low

- SP 500 with a 61% retrace of last leg up at the bottom so far (Bullish)

- Volatility to continue through election

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- Stocks- TFFP 28% gains taken before pullback late in week, New position issued early in week

- 3x ETF- New positions including LABU, SOXL moving in our favor

- ES Futures- Two huge profitable trades closed early in week for 38 and 28 points each (20% total gains)

- TPS- TFFP near all time highs and over a TRIPLE for members! New position added early in week also up!

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Market Commentary

Last weekends comments:

“Some of the “Generals” have finally fallen (Apple, Facebook, Tesla, Amazon etc) and usually once the Generals fall, the market correction is nearing an end during a Bull cycle. Wave 4 of 5 up is still consolidating, 3300 area on close key otherwise drop to 3250’s possible”

Turned out correct as we popped at the end of the week with Apple, Amazon, Tesla and other Generals moving up nicely off the lows. Usually this marks bottoms as the Generals are the last to fall and their rebounds are bullish signs.

It would appear by looking at patterns in the SP 500 and Biotech and QQQ that Elliott Wave bottoms are forming or are completed. The SP 500 had a steep 61% retrace of its last leg up and the NASDAQ 100 corrected 14% from the highs.

In addition as noted in a chart below the NASDAQ had a low of only 23% of listed stocks above their 50 day moving average at last weeks low.

3443 is the target to watch for an SP 500 rebound, not officially out of the woods yet.

This weeks charts include QQQ, XBI ETF, SP 500, IWM ETF and the NASDAQ 50 Day indicator:

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. We closed out several for 60% plus gains lately to make room for new positions. Among them TFFP, OTRK naming a few big winners for members.

Recent research includes TFFP at $5.83 several weeks ago, now up over 180% on their Thin Film Freezing technology for the delivery of drugs/vaccines. Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Ideas:

AMD- 8 week overall corrective base for Chip maker, a bit below 10 week EMA line but could bounce

LOW- 6 week corrective base for Home Improvement chain, also testing 10 week EMA line

DG- 2 weeks tight base near all time highs for Dollar General store operator

EBS- 7 week correction and possible reversal back up for Vaccine/Therapeutics developer/manufacturer

MRVL- 5 weeks tight pattern within an overall 11 week base. Integrated Circuits.

APPS- After a 35% pop off our list two weekends ago still looks bullish for App Developer

VIRT- 3 weeks tight base near highs, 3rd week in a row on the list

TMO- 5 weeks tight base near highs. Medical Instrument manufacturer

IIPR- 8 weeks tight base near highs, Real Estate REIT mostly for Cannabis growing properties, 2nd week in row on list

HZNP- 8 week base near highs for this developer of therapeutics

SCPL- 17 week overall base, started moving up again last week. Digital Game publisher

SAIL- 8 week base testing 10 week EMA Line for this recent IPO in the security space for Identity Software

FUTU- 5 week corrective pullback pattern. Chinese online brokerage holding company

DOYU- 7 week overall base near highs, SRP Re-entry position after pullback, looks bullish still. Chinese online gaming

CRWD- 4 weeks tight base near highs for Software security solutions provider

DDOG- 15 week flat base near highs for SAAS monitoring platform provider

ESTC- 6 week consolidation base near highs, Revolutionary search engine for multiple applications (Auto etc)

TENB- 5 week corrective pattern, pulling back off highs, on our list recently. Cyber Security Platform

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

Read up on my various offerings to take advantage of Bull and Bear cycles at TheMarketanalysts.com

Swing Trading and Momentum Stock Services:

Stock Swing Trading, 3x ETF Bull and Bear Swing Trading, E MINI/Micro-MINI Futures Trading, Momentum Growth Stock investing

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! 80% success rate since inception! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance Tax Favorable trading. See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,500 per contract roughly for members who are too busy to handle alerts and trading on their own. Track Record on fire since Late April change to Micro-Mini’s.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent sample TFFP up 180% in 9 weeks! Join and add momo growth stock plays to your swing trading! Use Coupon SAVE25 to save 25%.

Contact Dave with any questions (Dave@themarketanalysts.com)