04 Oct Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of October 5th

“Dave: Since April 14th: I’ve closed 58 trades that I’ve done in SRP and 3xETF; 41 positive; 11 negative; 6 even. That’s 70.7% positive; 19% negative and 10.3% even. Anyone that doesn’t believe your accuracy you can send them my numbers. Once again, thanks for your teaching, your consistency, your patience and, overall, for what you do. “The presence of knowledge, without the intent of sharing, is the greatest of vanities.” Now where did I first hear that quote?”

G. Harris- 10/4/20

Notes:

- Some selling at end of week but so far looks like normal pullback (SP 500 Chart)

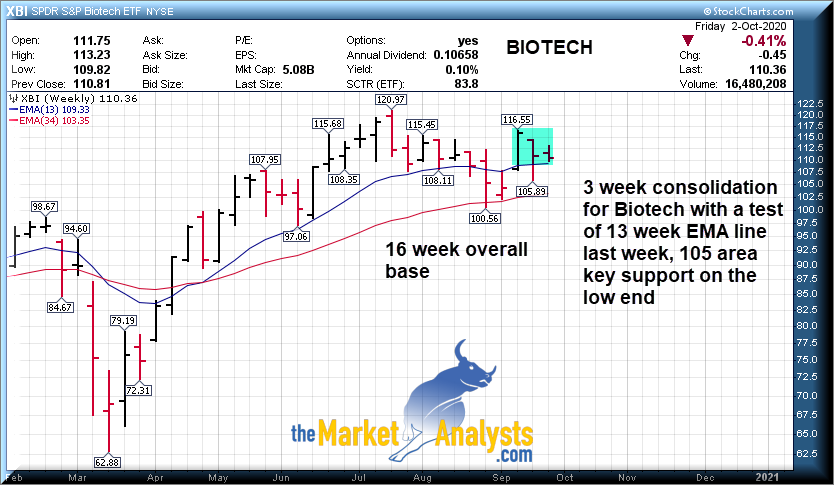

- XBI ETF Biotech still consolidating but looks bullish (Chart)

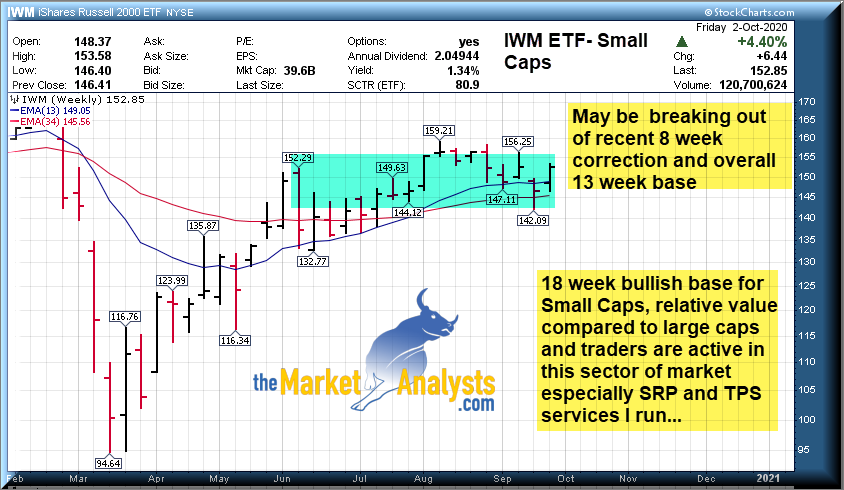

- Small caps (IWM ETF) also looking to break out of recent 8 week correction and 13 week overall base (Chart)

- Gold chart updated, 1850 key support to hold, 38% retrace in place of last upleg (Chart)

- Market may have priced in Democrat win over a week ago at lows (Higher taxes etc)

- Strong results in 3x ETF service (SOXL) and SRP (SAIL big mover last week)

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- Stocks- SAIL huge breakout on SP 500 inclusion, we cash in for 20% gains plus new alerts

- 3x ETF- SOXL gains taken at 268 before correction for 16% Gains on final 1/2, doubled up on one position late in week on pullback

- ES Futures- Small 17 point trade loss, guidance updated daily (Last week 66 points in gains)

- TPS- TFFP hits all time highs before pullback, new position added last week moving nicely

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Market Commentary

We had a pullback late in the week after a nice surge up from the prior weeks lows. Looks like a typical minor Wave 2 correction, and I’m watching 3295 area loosely for support on any further pullback, as the futures hit that level already during the week before a bounce up.

Small Caps look strong overall here and we have focused on those of late at SRP with good results. Also took down a strong 20% gainer in SAIL this past week as they got pushed into the SP 500 Index. Sometimes swing trading the small caps can be more volatile for sure, but if you get on front of a power move up in volume and time it right, the gains can be fast and furious.

Biotech also consolidating in a 3 week pattern and GOLD is trying to hold 1850’s for the Bulls

Charts on all of these below: 3443 remains resistance for SP 500

This weeks charts include IWM ETF, XBI ETF, SP 500 Daily, and GOLD Weekly

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. We closed out several for 60% plus gains lately to make room for new positions. Among them TFFP, OTRK naming a few big winners for members.

Recent research includes TFFP at $5.83 several weeks ago, now up over 200% on their Thin Film Freezing technology for the delivery of drugs/vaccines. Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Last week big winners in SAIL up 20%, APPS up 13%, RKT up 12% and DDOG also broke out.

Ideas: Some repeated if still looking bullish and others newly added

AMD- 8 week overall corrective base for Chip maker, just above 10 week line, looks bullish

LOW- 6 week corrective base for Home Improvement chain, also testing 10 week EMA line

DG-3 weeks tight base near all time highs for Dollar General store operator

DHI- 6 week base breakout for Home Builder, but still not too late to buy

EBS- 4 week flat bottom base at end of correction and possible reversal back up for Vaccine/Therapeutics developer/manufacturer

PLMR- 9 week base, just above 10 week EMA line near highs. Property/Casualty provider

PFSI- 3 weeks tight pattern near highs for mortgage servicer

APPS- Popped again last week but still looks bullish on 3 week ascending base at highs

IIPR- 9 weeks tight base near highs, Real Estate REIT mostly for Cannabis growing properties, 2nd week in row on list

BRP- 5 week corrective base, testing 10 week EMA line not far off highs. Brokers insurance products

TENB- 6 week corrective pattern, pulling back off highs, on our list recently. Cyber Security Platform

ESTC- 6 week consolidation base near highs, Revolutionary search engine for multiple applications (Auto etc)

SCPL- 18 week overall base, started moving up again last week. Digital Game publisher

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

Read up on my various offerings to take advantage of Bull and Bear cycles at TheMarketanalysts.com

Swing Trading and Momentum Stock Services:

Stock Swing Trading, 3x ETF Bull and Bear Swing Trading, E MINI/Micro-MINI Futures Trading, Momentum Growth Stock investing

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! 80% success rate since inception! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance Tax Favorable trading. See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,500 per contract roughly for members who are too busy to handle alerts and trading on their own. Track Record on fire since Late April change to Micro-Mini’s.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent sample TFFP up 180% in 9 weeks! Join and add momo growth stock plays to your swing trading! Use Coupon SAVE25 to save 25%.

Contact Dave with any questions (Dave@themarketanalysts.com)