31 May Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

3x ETF, SP 500 Futures, Market Forecasting, and Stock Swing Trading services via Subscription

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of June 1st

“At a time like this, I really appreciate people like you who have chosen to give back/pay it forward when it’d prob be easier to just trade for yourself. Thanks for literally sharing the wealth!” Cam- 3x ETF member

Notes:

- Market remains in confirmed uptrend

- SP 500 breaks out of 4 week range with 3% rally last week (Chart)

- Gold looks poised to break out of 8 week base (Chart)

- Investment Advisors 50.5% Bull and only 23.8% Bear (Wide lead for Bulls is contrarian bearish)

- Last weeks big winners were GAN up 42% (SRP Participated), PLMR up 20% and NLOK up 12% and BMRN up 9% off the weekly ideas list

- New Swing Trade Ideas list is large this week

Recent results and notes: Stock ,ETF , and SP 500 Futures Swing Trading Results

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

3 Trades in the 3x ETF service, two were profitable (SPXL, TNA closed early in week) and one was a loss on Friday as we got whipsawed out of LABU during the early day sell off. Overall profitable week. Stock service (SRP) closed out GAN for a 2nd time for 9-20% gains on each 1/2 of the trade and it continued higher. The ES futures service had a loss early in the week as we got whipsawed out of a long trade before a stunning V reversal. TPS Long term service continues to see upside movement in multiple positions with new positions coming.

Swing Trading and Momentum Stock Services:

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,400 per contract roughly for members who are too busy to handle alerts and trading on their own.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent samples CRBP, ATOM and more! Join and add momo growth stock plays to your swing trading! Email me for coupon

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Other Index commentary:

Last Weeks NYSE Note: May 25th report

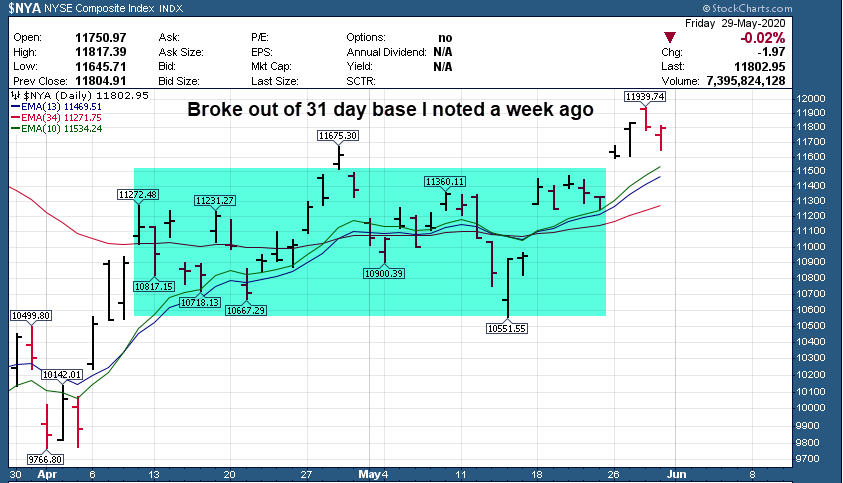

“NYSE is in a 31 trading day base, once again late this coming week we may see a large move one way or another. It would appear to be bullish at this time, but look for a sharp spike later in the trading week out of this range.”

NYSE Broke out sure enough out of the 31 trading day base to the upside- Dave May 31st Report

- NYSE broke out of its Flat Base officially this past week indicating more participation from lagging sectors. Real Estate notably was strong with REIT’s moving etc. Biotech took a breather but still looks bullish on the weekly views and long term as well. Small Caps also gaining strength.

- The SP 500 which I forecast also breaking out of a 4 week range to the upside and could be heading to the 3200-3215 area ahead as we move into June trading.

- Gold looks ready to break out of an 8 week base

- Stock Picking remains profitable for swing traders, drilling down into strongest sectors and strongest stocks as we do at SRP stock trading service.

Updated charts NYSE Daily update, SP 500 weekly and GOLD Weekly

Other Indicators and or Charts:

Advisor’s start turning more bullish: (Contrarian signal, but still room to move a little higher)

Advisors are now 50.5% Bulls and 23.8% Bears. (Last week 50% Bulls and 24% Bears). At the bottom or near bottom after the first bounce we were around 41% Bears and 30% Bulls, this has now reversed and Bears are dropping like flies.

Consider joining my subscription services at TheMarketAnalysts.Com for tradeable ideas and updates daily, 3x ETF, SP 500 Futures, Stock Swing Trading and Long Term Growth stocks (CRBP one example)

If not you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

It’s a New Economy, think outside the box:

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Last weeks big winners were GAN up 42% (SRP Participated), PLMR up 20% and NLOK up 12% and BMRN up 9% off the weekly ideas list

Price per share doesn’t matter, what matters is % movement!

Repeated from Last week: 6 from last week

ZYXI- 2nd week in row on the list, this name has done well. 4 week ascending base, Pain management

CATS- 4th week in a row on list, could have sharp rebound as Tele-Health play ahead, 7 week corrective base

AMD 7 weeks consolidation base pattern for chip leader

SFM- 4 week corrective base, Covid 19 healthy eating trend play. Organic and Vegan diets accelerating

INVA- 8 week flat base, New CEO, develops small molecule drugs for respiratory disease with Glaxo

CHGG- 7 week base, online education tools, textbooks, etc. provider.

5 New Names for June 1st week:

DDOG- 3 weeks tight, first wrote up at 53 but still looks good in 60’s

LVGO- 3 weeks tight base, written up many weeks ago before huge run, now consolidating. Remote medical management devices

GDDY- On the list again after being on weeks ago and moving up sharply. Go Daddy seeing rise in revenues and in a 3 week tight base now ear the highs

SIMO- Back on the list, 8 week overall flat base with a 1 week spike up the week we had it on our list recently.

PETS- 5 week corrective base near highs for Pet Meds express.

NARI- 2 week Post IPO base pattern, new IPO, treating Venous diseases

CRNC- Nice pullback

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! CRBP recent huge winner! Fresh ideas every month.

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

ESAlerts.com- Auto Trading of Micro MINI contracts, $1,400 roughly per position size. $5 move for each 1 point SP 500 move. Trades executed on your behalf based on our Advisory automatically. For those too busy to follow alerts and trade on their own.

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)