28 Jun Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of June 29th

“At a time like this, I really appreciate people like you who have chosen to give back/pay it forward when it’d prob be easier to just trade for yourself. Thanks for literally sharing the wealth!” Cam- 3x ETF member

Notes: Several charts to review, market with lots of topping signals

- ABC wave 2 count takes over for SP 500 etc, could be some more downside ahead (Chart)

- End of quarter rotation, re-balancing having effects into month end

- Put to Call ratio rises after being abnormally low near market highs recently (Chart)

- A few indicators charted showing extreme exuberance readings for Tech etc vs SP 500 (See Charts)

- NASI Indicator toppy short term for NASDAQ stocks (Tech, Biotech) (Chart)

- Biotech should still lead, pulling back a bit after early surge last week

- Swing Trade ideas updated

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- Stocks- Closed out PRVB, CORT and part of ATOM for nice gains on all *8% plus*, raised cash levels high

- 3x ETF- Booked 14% gain on LABU early in week, entered TZA and DRV (Shorts) late in week

- ES Futures- Booked a 30 point gain early in week, guided members ahead of downside

- TPS- One of our recent plays is poised to double we think

Swing Trading and Momentum Stock Services:

Flagship SRP Stock Swing Trading and Market Forecast Service: Track Record is online, 10 years since August 2009 inception, 70% profit rate trading stocks based on fundamental and behavioral patterns both. Morning Pre Market reports, Buy and Sell alerts, follow on advice daily on all positions, SP 500 Banister Wave models daily. Monthly, Quarterly, Annual options.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online. Pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! 80% success rate since inception! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts and guidance Tax Favorable trading. See details here: Stocktwits.com

Auto-Trade ES Futures service– ESAlerts.com $149 a Month, $349 Quarterly, We auto execute Micro-MINI contracts $1,500 per contract roughly for members who are too busy to handle alerts and trading on their own. Track Record on fire since Late April change to Micro-Mini’s.

Tipping Point Stocks– A long term momentum growth stock service looking for 50-200% gains. Recent sample DYAI! Join and add momo growth stock plays to your swing trading! Email me for coupon

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and Other commentary: TOPPING OUT?? Signals persist of irrational exuberance

Last Weeks SP 500 Forecast Note: June 21st Report

“We did not get much above 3170 which was my high end marker to watch. So at this point a C wave down to 2910-2835 is still possible to complete an ABC Correction off the 3233 SPX highs…

I can make a case that we are in a new set of 5 waves up from the 2760 area, and if so after this pullback we rip higher to all time highs in a 3rd wave of 5 up. The other option remains valid that we are correcting that entire move of 5 waves from 2191 to 3300 area and this is a larger degree Wave 2 which would take SP 500 to 2835 or lower even.”

The preferred view that we were correcting the rally from March 23 lows to 3233 highs came into clear play. I also had discussed the end of quarter stock/bond re-balancing that is coming, plus window dressing, and Russell Index changes causing issues. They did as we saw a lot of volatility last week.

Trading the behavioral waves

In the 3x ETF service first we were super bulls on Monday going long LABU (3x Bull Biotech) off last weeks bullish charts in the weekly report. We saw a 14% gain from our entry in 24 hours and took it. Later in the week we were working into BEAR positions via TZA and DRV 3x Bear ETF’s. So you have to be able to swing with the moves and anticipate them in advance to profit, and importantly TAKE PROFITS! In all my services we have profit taking methodologies that are deployed every time without fail.

The market should continue some volatility possibly for a few weeks after the 13 week rally. We also have the pension fund monies usually coming in early July after the re-balancing so this week should be volatile along with the Friday holiday for the 4th of July. A light volume trading week could exacerbate moves. Then we will be getting ready for the 2nd quarter earnings reports soon as well, prepare for some roller coaster action.

Keep your eyes on that 2910 and 2825-2830 zones for the SP 500, areas I’ve been pointing out for a few weeks as possible ABC Wave 2 bottoms

There are multiple warnings over last few weeks of topping indicators, see a few interesting charts in the “Other Indicators” section below. Short term issues are extremes in optimism and trading of tech stocks by retail investors, NASI momentum indicator for NASDAQ looking toppy etc, and MSCI Growth vs Value buying at extremes.

Charts below:

SP 500 ABC Pattern updated:

NASI momentum indicator Toppy

PUT TO CALL Ratio adjusting

Other Sentiment Indicators and or Charts: LOTS OF TOPPING INDICATORS

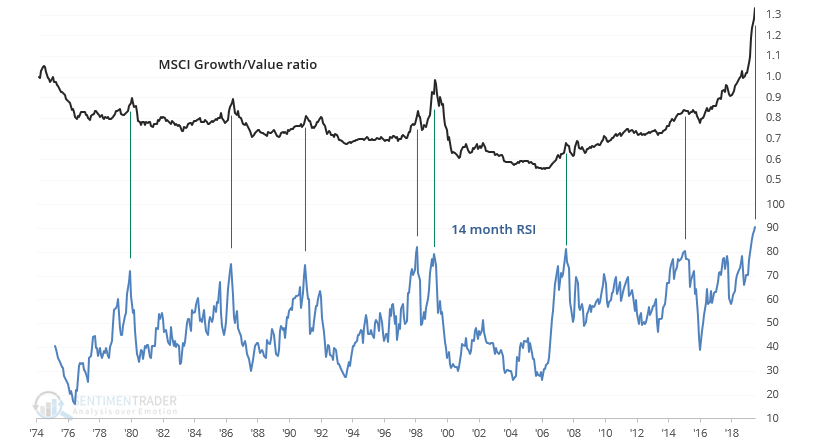

MSCI Growth to Value Stock ratio at soaring highs , higher than 1999, 2007, 2015 tops

*Source sentimenttrader.com

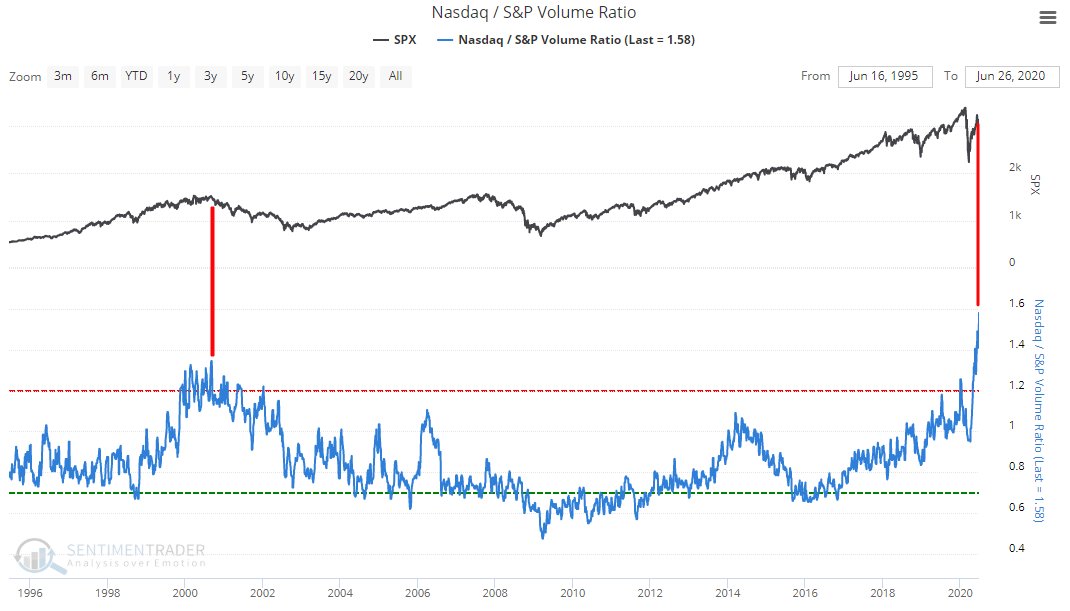

NASDAQ Trading volume vs SP 500 also at highs not seen since 1999 dot com bubble top

*Source sentimenttrader.com

Investment Advisor’s extremely bullish with few Bears: (Contrarian signal)

One of the many indicators I use to help me feel more confident in my Elliott Wave projections includes Investment Advisor surveys. 57.3% Bullish Advisors vs only 18.4% Bears. Typically when we are at 3 to 1 ratio its at extremes, often near market interim tops. We are currently correcting that advance from March 23 lows.

Consider joining my subscription services at TheMarketAnalysts.Com for tradeable ideas and updates daily, 3x ETF, SP 500 Futures, Stock Swing Trading and Long Term Growth stocks (CRBP one example)

If not you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Last weeks big winners were BOX and CORT, action was rough late in week

Repeated from Last week: (Consolidating or did not yet break out)

GMAB- 3rd week in row on list, 3 week ascending base is bullish. This was on my list in the 20 area weeks back as a Post IPO Biotech play. Now in the 32 area, still looks good though.

SAIL- 3rd week in row on list. 6 week base pattern right side of base. Identity software that assists organizations.

AAXN- 3rd week in row on list. Law enforcement devices like Body Cams etc. 4 week corrective base. Should see orders explode going forward given the police issues around the country

TSM- 4 weeks tight base building a bullish right side of base for this chip maker

DOYU- Post IPO Breakout after 11 months. Chinese stocks getting hot, provide online gaming services, this has a nice 2 weeks tight base pattern, often explosive.

New Ideas:

SFM- 8 week corrective base with move up late in week. Sprout Farmers Market for Organic Food movement etc.

BJ- BJ’s in a 5 week base near highs. Looks poised to break out

NARI- 6 week Post IPO base, returning to list. Recent IPO of Venous disease solutions (Biotech)

DT- 2 weeks tight base near highs, once again on list. Security solutions provider for enterprises

FTNT- 8 week overall base for threat management systems provider

CHGG- Returning to list again, 8 week overall base, almost broke out to all time highs last week. E Book, Text Book etc College play

PLMR- Returning to list again, 5 week overall base near highs for Specialty Insurer

NBIX- 6 week base near 52 week highs for this Bio Pharmaceutical play

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! CRBP recent huge winner! Fresh ideas every month.

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

ESAlerts.com- Auto Trading of Micro MINI contracts, $1,400 roughly per position size. $5 move for each 1 point SP 500 move. Trades executed on your behalf based on our Advisory automatically. For those too busy to follow alerts and trade on their own. TRACK RECORD ONLINE

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)