10 Jun Weekly Elliott Wave Forecasts and Stock Trade Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

Details on all of our services at the bottom of this report

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com

Last week huge gains in 4 SRP Open Swing Positions, SNAP, GH, TNA, and PINS. We took partial profits on all 4 and are holding 1/2 positions. Join us and profit!!

Weekly Stock Market and Trading Strategies Report June 10th week

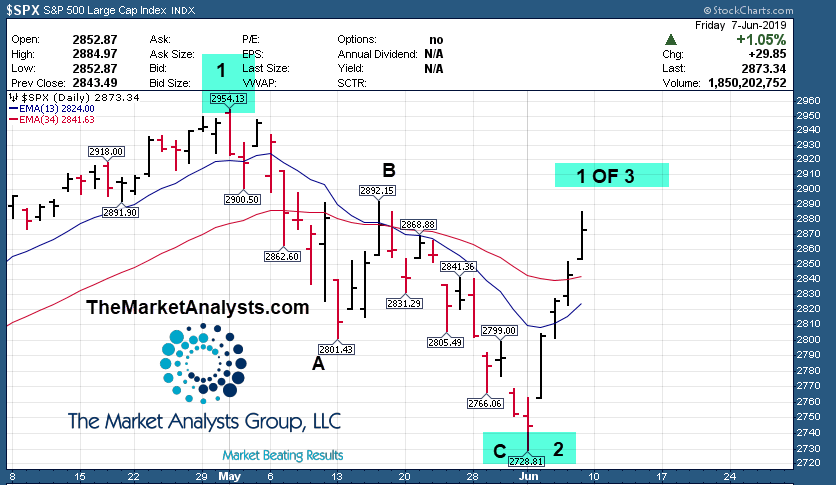

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: ABC Wave 2 down completed at 2728, Wave 3 up underway, should pull back in minor 2 soon

Long Term: Major Wave 3 to all time highs underway to 3,000 plus

Long Term View: 3 plus year Monthly Chart : Wave 3 of 3

We had been projecting a Wave 2 to 2715 area and that hit this past week satisfying our ABC wave 2 requirements. We now see the SP 500 in Wave 3 up, this should take us to all time highs ahead.

Short Term View: Wave 1 up of 3 underway from 2728 low of Wave 2

As we have been projecting since May 10th, 2715-2725 area was the target for C of ABC correction from 2954 Wave 1 highs. Wave 2 now completed and we are in Wave 1 of 5 of 3 up. Market a bit extended short term, Wave 2 of 3 ahead after we peak out in 1 up.

Market Notes:

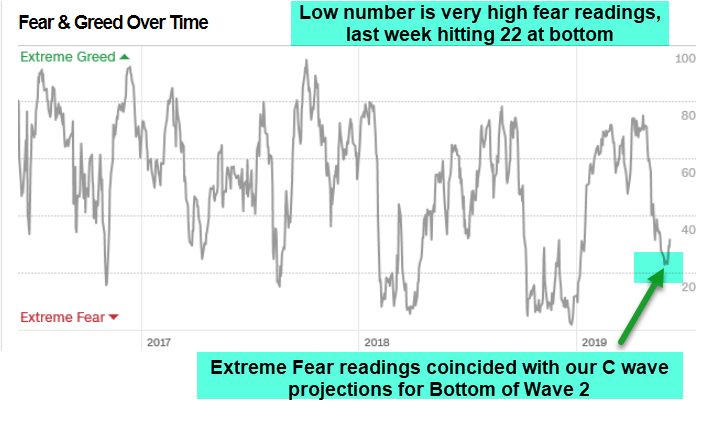

CNN Fear Greed Gauge was another bottom signal last week

I often use other indicators outside of traditional technical analysis in order to “Check my work” if you will. In this case, as we approached my C wave projection of 2715-2725 on the SP 500, I checked the CNN Fear Gauge and it was confirming a low was likely, adding more strength to my forecast models. Also Bulls in the Advisors poll from IBD had dropped to 40% from a high of 55% over last 12 months, and 50% just a few months ago.

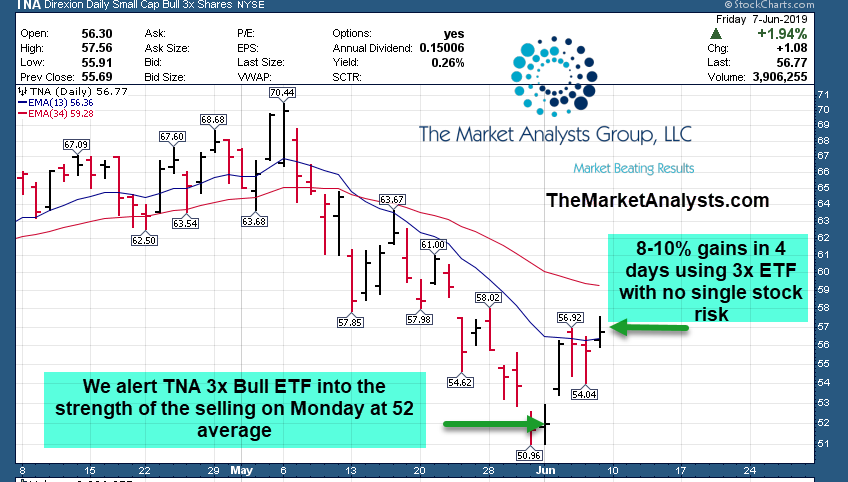

One of our Trades was the TNA 3x ETF getting long on Monday before the rebound. Last weekend we projected a Small Cap bottom and reversal in the Weekly Report. 8-10% gains in 4 days for SRP.

- Market hit my 2715-2725 pivot and rebounded as sentiment bottomed out

- Should work to all time highs on SP 500 etc.

- When the Generals finally fall, the market bottoms- Monday 6/3 Morning Report comments

- Huge gains in GH, TNA, PINS, and SNAP swing trades for SRP members last week

Weekly ideas and tips on Swing Trading Success: Big gains last week for SRP swings

Look for weekly base patterns of 5, 8, or 13 weeks in duration. We were watching the relative strength stocks during the ABC correction and as we saw the C wave nearing a bottom, we got long several including SNAP that came out of a 13 week base, GH, PINS etc. GH went from 75.50 entry to 92 within 10 days out of a base, it had relative strength during the C wave down.

We booked big gains on all of those last week on 1/2 of the positions on the way up. When markets are in corrective Elliott patterns, start paying attention to those who are holding a tight range and then narrow down the list, and of course we will be doing that here at SRP.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

Last week multiple winners off our Swing list including ZM which soared 20% on Friday, GH which ripped 15%, PAGS up 9%, RGEN up 8%. If they break out big we take them off the list. SRP members had GH and are still 1/2 long with 20% gains plus now.

We have 11 names this week, 4 repeated from last week (PODD, SE, UPLD, PCTY)

PODD- CHART LINK

5 week ascending base near highs, develops Wireless handheld insulin infusion systems for people with insulin depending diabetes. 2nd week on the list.

SE – CHART LINK

Stock was up 8.5% last week from our Listing here, and still attractive fundamentally and technically. Online gaming and E commerce shopping giant in Asian region. SRP got long at 25.50 a few weeks back and took gains at 20%, but still attractive after it pulled back and now testing highs. 3rd week on the list.

UPLD- CHART LINK

7 week base near all time highs. Cloud based work enterprise work management software provider. Looks poised to break out , 3rd week on the list.

PLNT- CHART LINK

8 Week base, we first profiled PLNT back at $25 last year, now $78 and still attractive. Essentially a Real Estate Trust we called it back then, diguised as a Gym. Pack 3,000 gym members into a warehouse for $10-$15 per month and guess what, you make money. Nobody cancels… brilliant.

ESNT- CHART LINK

6 Week base near highs. Offers private mortgage insurance and reinsurance in all 50 states.

PYPL- CHART LINK

7 week base near highs. Digital and mobile payments provider, ubiquitous.

LPLA- CHART LINK

6 week base near highs. Brokerage advisory services provider.

MNST- CHART LINK

Nearing 52 week highs breakout. Alternative beverage maker, expanding into new markets.

CZZ- CHART LINK

12 week overall base with 3 week ascending base currently. Brazilian provider of refined organic sugars, also ethanol and fuel products.

NEO- CHART LINK

6 week base near highs. Provides laboratory testing services. Close to breakout.

PCTY- CHART LINK

7 week base, fell hard to 87 last week then closed at 98. Provider of Human Capital, Payroll processing software. 3 weeks tight base near highs.

Read up at TheMarketAnalysts.com for more details

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)