12 Oct Tipping Point Stocks Crypto Research Report

The Following research report was issued to tippingpointstocks.com members on October 12th 2021. You may subscribe to my frequent research and use code SAVE25 to save 25% off the annual $999 rate. In 2020-2021 we had 9 stocks double or more. I look for companies at the Tipping Point of growth and investor recognition with catalysts to create 50-500% gain potential over 6-18 months.

Read up at Tippingpointstocks.com

DEFTF- DeFi Technologies- “Your access to the next financial revolution”

$1.67 at time of report

OTC Exchange, up listing to NASDAQ by year end is the plan, Use limit orders.

340 Million Market Cap

Investor Deck Sept 16 2021 (Already out of date due to higher AUM and New CEO appointment and more)

$1.67 at time of report

6 month target $6 to $10 a share based on 1.5x to 2x AUM valuation modeling and growth of AUM, plus NASDAQ up list possible by year end.

A way to have exposure to the Decentralized Finance and the Crypto boom without trying to pick a coin/token. The business for Defi Tech is about to explode in Europe as they now list in Germany with their ETP products and soon a EuroNext listing (5th largest exchange in the world) could blow the lid off growth- The Tipping Point is here- Dave

Valuation/Share Structure/Highlights:

- 200 million shares x $1.70 is a 340 million market cap.

- Valuation at about 1.6x Assets Under Management (AUM) at low end of industry valuation metrics

- 40 million in liquid assets plus 4 million shares of Hive Blockhain (HIVE) valued at 12 million for about 52 million in liquidity available

- 0 debt

- Company has been quietly buying back shares last 2 months per a filing they made.

- No need to raise capital at this time or dilute

- AUM has grown from 107 million on August 15th to 250 million estimated on October 12th

- Many fund managers and institutions are NOT ABLE to participate in Coins/Tokens but they can get involved in ETP’s and or Individual stocks (MARA, RIOT, and now DEFTF especially once on NASDAQ)

- Expansion into German Exchange could smash growth exponentially higher

The Tipping Point is here for decentralized finance and institutions getting involved. This sector is growing at 2x the rate of the internet growth to give you an idea of asset explosion in the space. Picking the right coin or token can be volatile and difficult. Plus you have to store it somewhere, figure out how to securely stake it for rewards/interest, not lose your security codes, deal with volatility and more. Nothing wrong with investing in Cardano or Algorand, two of my favorites long term, but still a smarter way to play is via DEFTF in my opinion for growth and upside with diversification. You participate via Exchange Traded Products or ETP’s via DEFTF share ownership. You get an “equity wrapper” if you will around the entire growth of the crypto asset space, as assets grow worldwide, valuation grows for DEFTF.

I have been following and forecasting Bitcoin for four years now and fairly accurately. Recently I noted a likely ABC correction was likely in Bitcoin and therefore Crypto so a short term bear cycle was underway. We then rallied off the A wave lows under 30,000 to 52,000 on Bitcoin. That is when I said we would have problems around 51,000 and a possible C wave pullback. Bitcoin then dropped back to about 40,000 in the C wave.

I have discussed a Crypto based Token/Coin play that would possibly come next for TPS portfolio. Originally I was planning on recommending a coin/token, but then I thought it better to be diversified all under one play, that being DEFTF ahead of their NASDAQ up listing. However, we gain better exposure to Bitcoin, Ethereum, Solana, Cardano and more assets going forward. As DEFTF shareholders we participate in “Staking” of these coins (Basically rewards by getting more coins as you hold them, which is really like earnings dividends or interest on your coins), and also the trading profits and spread on these coins via DEFTF ETP products and also the AUM growth.

This correction is now over and Crypto and Bitcoin is back in Bull mode in my opinion. Some of the “Alt Coins” are basing or correcting (Cardano, Algorand etc). DEFTF is involved mostly in the larger cap coins like Bitcoin, Etherium, Solana, and Cardano, Polka Dot etc. via Exchange Traded Products (ETP’s) mostly in Europe… with more to come, again offering diversification for the Crypto bulls and investors like us.

DEFTF has 90% gross margins, virtually all of their corporate expenses are salaries to employees with some marketing expenses as well. This leaves them with a potentially very high return on capital, a higher PE ratio going forward, and potentially explosive earnings per share as they RAMP UP their AUM.

DEFI Tech is about to significantly increase their assets under management as they get listed on the German Exchange for their Exchange Traded Products (ETP’s) as I type this week officially and dramatically expand their network of opportunities. The LOW END valuation in this sector is about 1.5x the AUM (Assets under management). In the past 60 days their AUM has ballooned from 100 million to 210 million as ETP’s from their Valour subsidiary continue to explode.

As these AUM explode, the growth rate leads to a higher AUM multiple for shareholders, higher stake rewards, more trading profits, and a higher share price ahead of the NASDAQ up listing. It’s a virtuous up cycle if you will and the time to get invested is now before several catalysts start to hit in 4th quarter in my opinion.

The balance sheet is pristine, they are now turning profitable as well.

I spoke with the CEO and Executive Chairman Russell Starr on a phone call October 11th. Russell has been an institutional trader and in fact built what is now the 3rd largest Broker-Dealer in Canada, so he knows how to build a securities driven business.

This is a story of growth over growth over growth over growth- Russell Starr, CEO 10/11/21

I had last spoken with Russell in the late Spring and told him I would monitor progress and get back to him when I felt timing was better for my TPS members and after I had time to evaluate. Russell basically said in the call that both 3rd quarter and 4th quarter earnings and growth are going to blow investors away. He believes as they now list on the German exchange which is the 12th largest in the world and Europe being their main focus for Crypto, that their AUM will explode.

They have 10 new products planned and approved for launch near term and he thinks their AUM can go from 210 million to 500m, to 1 Billion literally in the coming 3-4 months.

However, the really big catalyst in addition to Germany entry, that nobody sees coming, is their likely listing of assets or ETP products on the Euronext exchange which they are in discussion with now. This could come in the next 2-4 weeks or so hopefully, and that is the 5th largest securities exchange in the world. This move if completed will rubber stamp DEFTF as extremely legitimate in the crypto space and could smash the shares higher ahead of a planned NASDAQ up listing.

If I take the low end valuation in the sector per DEFTF management guidance of about 1.5x potential AUM of 1 Billion we could put a possible value of 1.5 Billion on the market cap, divided by a FULLY DILUTED share count of 250 million and come up with a price target of $6 per share conservatively. Keep in mind this 1.5 x AUM is the LOW END of the typical range Wall Street is paying. If we move this to 2x then we could see closer to a $8 share price for example.

This is a way to participate in the exploding growth of Crypto/Decentralized Finance sector with a pureplay company that is exploding in growth and should see a multi-x return over next 15 months or so.

Currently the market is valuing them at 1.6x assets under management so if this is a linear model of growth, my $6 target can be achieved within 6 months I think if they hit the 1 Billion AUM number. Even if they only get to 500 million in 6 months, we can still see $3 plus per share on the conservative side.

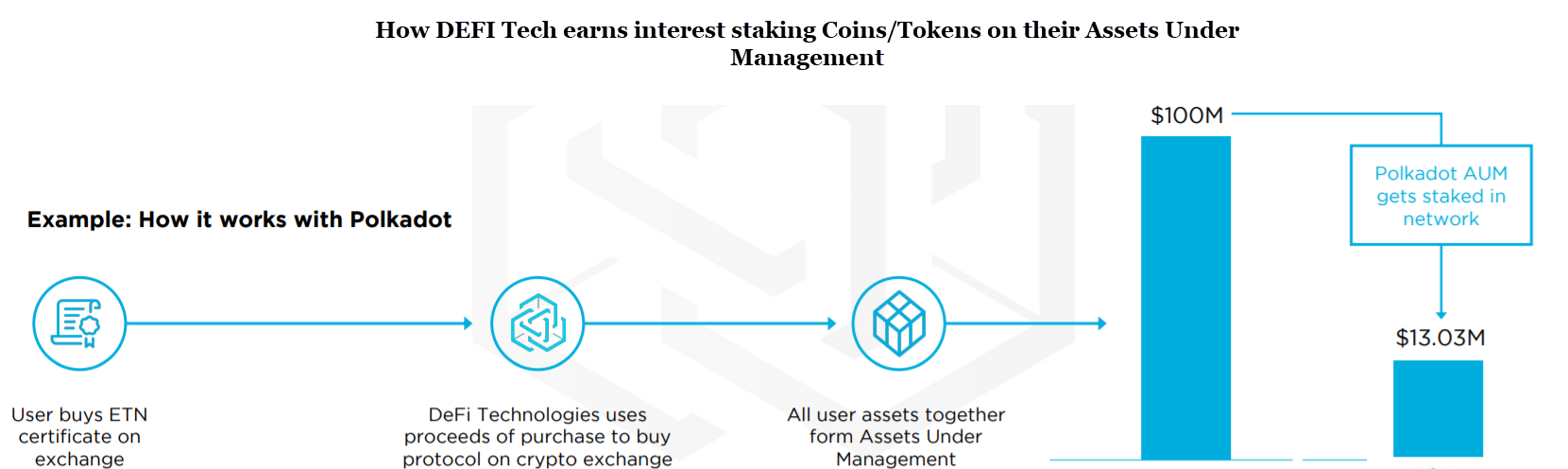

Lets quickly go over how DEFTF makes money and why this business model can explode on the upside exponentially:

How DEFTF makes money “Staking” coins/assets in their ETP’s: (Sample Polka Dot pays 13% currently)

Defi also has a Venture Capital arm which invests in emerging coins, larger asset value coins, and other companies and protocols in the DEFI space if you will. Early returns have been off the charts, but as of now this makes up a small % of their assets.

Defi Yield- They plan to come out with an ETP which is a DEFI Yield play, investors should love this and will add to AUM.

Nodes- A decentralized network is not run by a central authority. It therefore needs to have a network of “nodes/validators” that together determine how the network is run. These nodes are maintained by

independent organizations. DEFTF makes a % transaction fee for each validation transaction on a network. These run at 90% margins per the CEO conversation. He estimates they can push this early stage business to 10 million in next 6 months or so with 9 million net profit added to bottom line alone.

Finally, they make money trading some of these coins/assets and profiting on the spread. CEO Starr says investors would be surprised at the profits made in this area as well, and as their AUM grows this continues to grow as well

Keep in mind also that many institutions and or banks can’t buy from crypto exchanges like Coinbase for example. Bridging that gap between crypto and institutional and retail accounts is what DEFTF will and is doing. The every day investor gets direct exposure to these trends without trying to pick the winners.

A VIDEO interview worth a watch with CEO Starr and the man who recommended Bitcoin at $400

Investing Guidance: All research is subject to our Terms of Service agreement.

There appears to be alot of shares available at 1.70 area from the charts. During the Crypto bear cycle in the spring summer this stock was volatile, investors will take back their break even capital on a recovery typically, then miss the next explosive move.

My advice is to use Limit orders which you need with OTC stocks anyways, place them from 1.60-1.75 loosely and work your way in. I do think we may get an update as soon as this week on their AUM number which may or may not move the shares near term. Either way, there does appear to be plenty of supply down here to buy into. There are also low basis shares that could be hitting the market, temporarily providing supply to accumulate. As this moves onto the NASDAQ hopefully this quarter, a lot more volume and investors will be able to come in.

Buy up to 1.75 add to 1.55/1.60 on dips

6 month target from 6 to 10 possible in my opinion