15 Oct Swing Trade Ideas and Forecasts Report -Nearing a High?

Publishers of Stockreversals.com (Opt in Free)

Stockreversalspremium.com a Swing Trade and Advisory service

TippingPointStocks.com a Long Term growth stock advisory service, just launched October 4th 2017! Join now at Charter Member Rates!

Weekly Forecasts and Trading Ideas Report:

- SP 500, Biotech, NASDAQ, GOLD forecast and chart notes

- Market Notes and Internals

- Update on Fear and Greed Index

- NYSE indicators nearing typical peak highs

- Swing Trading for big gains sample- NTNX

- 3 Post IPO base ideas

- 15 Swing Trade Candidates:

If not yet a Stock Reversals Member, opt in free today to get our free reports and intra-week updates!

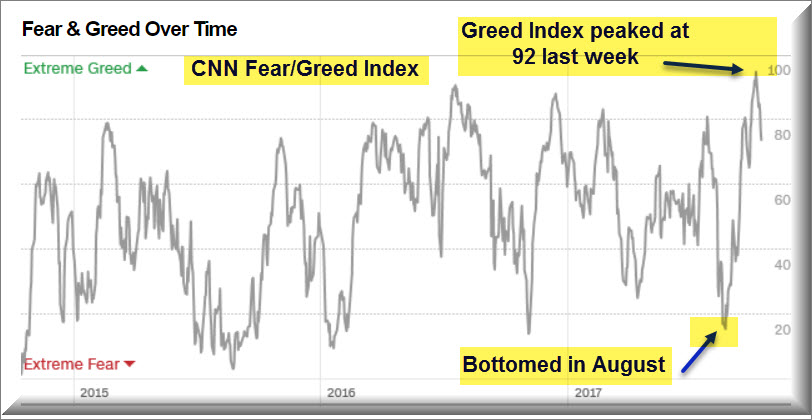

The indexes are near highs and consolidating on the daily charts. We enter Monday into an 8 trading day consolidation in the SP 500 Index. Of note, we are near 1 year highs for the percentage of NYSE Stocks trading above their 50 day moving averages at 79% reading. The percentage of Bullish Advisors is at multi year highs at 60% with only 15% Bears. The Greed Index hit highs last week at 92% on the CNN Fear/Greed Gauge. NYSE short interest is starting to decline.

All of this leads to warnings of a correction ahead because markets do not go straight up. We have a 2579 pivot on the SP 500 Index we projected a few weeks ago to watch and the other is 2608. The SP 500 on the weekly charts is trading well above the 10 day EMA line, typical near tops or ahead of corrections.

With the above in mind, the markets obviously have been favorable for swing trading but taking profits along the way with discipline is always our mantra at SRP, make sure you are banking some of these paper gains.

SP 500 Update: Daily and Weekly Charts

Keep eyes on a possible large move on Tuesday, and also 2579 pivot resistance

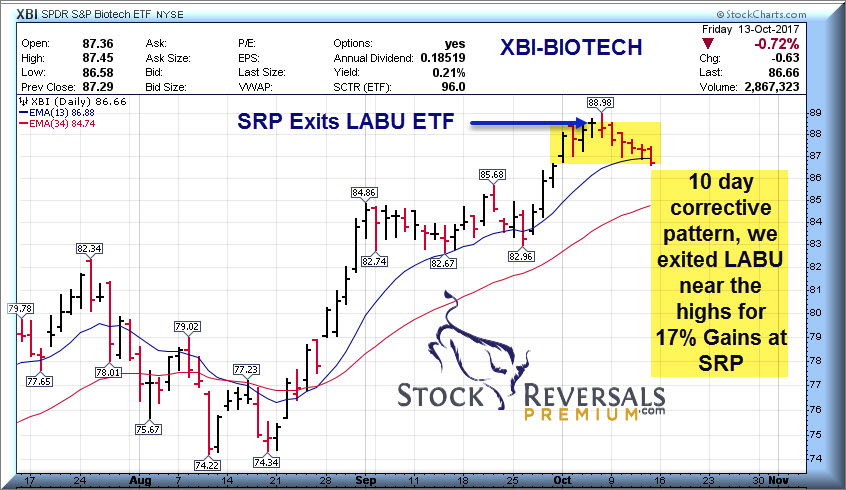

Biotech Update: XBI ETF

We took profits on our 17% gainer LABU 3x Bull ETF over a week ago at SRP as the move looked extended on Biotech. That turned out correct and now we are in a 10 day corrective pattern, with another 3 trading days or so likely ahead of meandering. Biotech sentiment is running at extremes, perhaps evidenced as well by the Investors Business Daily weekend paper highlighting the sector.

Gold Update: 1325 near term target

We projected a bottom at 1265 on Gold a few weeks ago, Gold hit 1263 and then we projected a rally to 1300. Gold hit 1300 and pulled back and we updated this week with a 1325 projection which is on track right now. Gold could actually start building momentum relative to the SP 500 and other indices which are stretched near term.

Market Notes:

As mentioned at the top of the report:

NYSE readings are at extremes in terms of percentage of stocks above 50 day moving average at 79%, the high 83% in January of 2017. Although not a perfecd top indicator its a warning to be a bit more aggressive taking profits.

The CNN Fear/Greed Indicator has cooled off from a week ago when Greed hit 92%. However still pretty high, note the bottom in August where Fear was very high (Greed was low) as the market bottomed out.

Bulls are running at 60% in Advisory Surveys, Bears only 15%. This 4 to 1 ratio is historically at extremes and again another warning of a corrective pattern likely ahead.

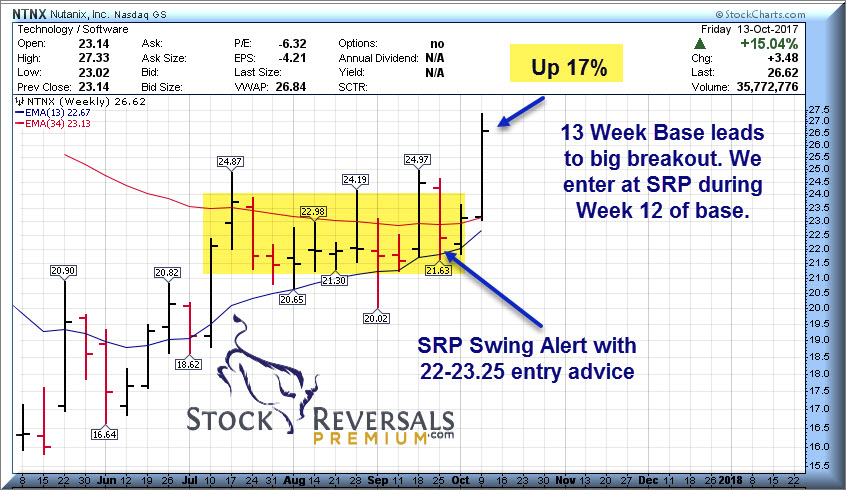

Swing Trade Review: NTNX- 17% Gain using Behavioral Base Pattern for Entry

Often at SRP we use base patterns to enter swing trades. We focus on fundamentals and technical’s both, and look for behavioral patterns in the chart where investors have given up or moved on from a good company. We try to time the entry during the final pullback or just prior to a breakout after a stock being “dead money” for a period of time.

In the case of NTNX we are up about 17% in a few weeks because we identified a 12 week base pattern heading into the end of the 3rd quarter. We know that money managers are often moving stocks around in portfolios at the end of a quarter and can cause temporary downdrafts which we take advantage of. This was the case with NTNX going from near 25 to 21.60 in the last week of the quarter.

This was a 12 week base , so we often look at 13 week base patterns for breakout attempts. We alerted to buy NTNX during the 12th week of the base and held it during the 13th week. In week 14 the stock broke out and ran up, giving us very strong gains at SRP. This was a combination of behavioral base patterns combined with fundamentals that are improving, and getting in front of the uptrend.

Swing Trade Candidates: 15 Swing Trade Candidates plus 3 IPO base ideas

Every week we provide 10-18 names of Swing Trade candidates that look attractive for both technicals and fundamentals. This past week big winners off last weeks list were KEM and ICHR (up 24%). At SRP we sent actual alerts via Text, Email, and Post with entry and exit advice and daily updates in pre market. However, since we can’t issue 18 alerts every week we like to provide our members with our best intermediate ideas to also consider.

Here is this weeks list:

Post IPO Base Ideas:

ATH- Reinsurance provider nearing breakout

PUMP- Energy services provider nearing breakout

JAG- Permian Basin driller in long base

WUBA- 8 week base pattern, this one washed traders out a few weeks ago with an unexplained $10 1 day drop on no news, sometimes makes you wonder. Still forming nice 8 week base though, and this is the leading online classifieds provider in China.

OSTK- Overstock in a 13 day base pattern after a spike. They are partnering up in a joint venture on Crytocurrency trading platform for ICO offerings. Interesting to say the least.

CAVM- In a 10 month corrective base pattern, this chip company has strong fundamentals.

KEM- An SRP swing position this is up 22% on the back half of the trade from 21.60 alert 2 weeks ago. This stock still looks attractive from a weekly base perspective. Materials for the Solar industry, we got long after a secondary offering knocked the stock down, now its at or near 52 week highs

STMP- 11 week base pattern near highs for Stamps.com, still attractive even though we first wrote this up at $90, now over $200

ATHM- 11 week base pattern, double bottom possible on the daily charts for Chinese content and e commerce automobile sector provider.

NTRI- 3rd week in a row on the list, Nutrisystem has traction for dieters and in a 7 month base with a 13 week base on base pattern. Nearing a breakout here.

EDU- 6 week base pattern, Chinese language and test training firm

SUPV- 3rd week in a row on the list, 5 week ascending base, PE 14 for this Argentinian Financial firm

FB- Facebook is in a 12 week base, expect breakout soon

GTN- Pullback on Gray Television after being on our list two weeks ago and popping. This is in an 8 month base.

ESNT- 15 week base pattern, close to breakout for this mortgage insurance provider now in 50 states, PE 14

RP- RealPage provides software and accounting tools for the Real Estate owners who rents to tenants. 13 week base.

GWRE- 6 week base pattern, company handles claims and underwriting software services for insurance industry

CELG- Celgene is one of our favorite blue chip growth stocks in Biotech, a buy and hold company. Nice pullback recently.

SRP Update:

This past week we saw our KEM and NTNX positions soar, upwards of 14-22% gains plus we issued two new swing trade alerts and took profits on 1/2 of our NTNX and KEM swings and all of our KTOS swing. Consider joining us to learn and earn!

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analyst)

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com