08 Nov Morning Positions, Strategies, and Stock Market Forecasts Report

Below is a real time sample of a pre-market report sent every morning pre-market open to SRP stock Swing Trade members. If you are interested in joining and not yet a member, use code SAVE25 to try us out for 30, 90, or 365 days at 25% off. You can join HERE

Morning Trading Strategy and Market Update Charts and Notes

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…” Bill L. 1/3/22

The Weekly Stock Market and Trading Strategies Report

The weekly report was published this weekend Nov 6th. Also, the Swing Trade ideas list is updated and published at bottom of this morning report. This list reflects the market conditions of the time period and sector analysis etc. and gives further ideas for swing trades

Morning Trading Strategy and Market Update Charts and Notes with Dave:

SP 500/Market Updates: Larger Picture Dave Banister Elliott Waves Overview

- Bull Cycle Wave 1 likely topped at 3393 Feb 2020 due to Corona Virus

- Bear Cycle Wave 2 ended at 2191 on March 23rd

- Larger Bull Cycle Wave completed at 4818 2021 highs

- 3640 tested twice for double bottom short term (6/21)

- 3 waves up underway since 3640 lows peaked at 4327

- Wave C extended to 200% of 1 and peaked at 4327 area

- 3500 target hit on 10/13, (3491) 3800 and 4000 upside targets possible (10/18 update)

- 10/26 3915, 4000 are the next levels to watch per notes last weekend (3912 uptrend high)

- 11/3- 3650 key support

Stock Market, Sectors, and Trading Notes/Charts:

Chip stocks still bouncing as SOXL went up another 6% yesterday in the 3x ETF area. Good sign for market, mid term elections are today/tonight so could swing the market a bit favorably I think if the GOP takes over House and Senate.

In the meantime, lots of Bears all over CNBC on the rare occassions I put it on which is contrarily bullish.

Tech stocks may continue to tumble and some are going much lower, but we will focus on the stronger sectors like Energy and emerging sectors for our swing trades and the obvious individual catalyst type opportunities like BIVI etc.

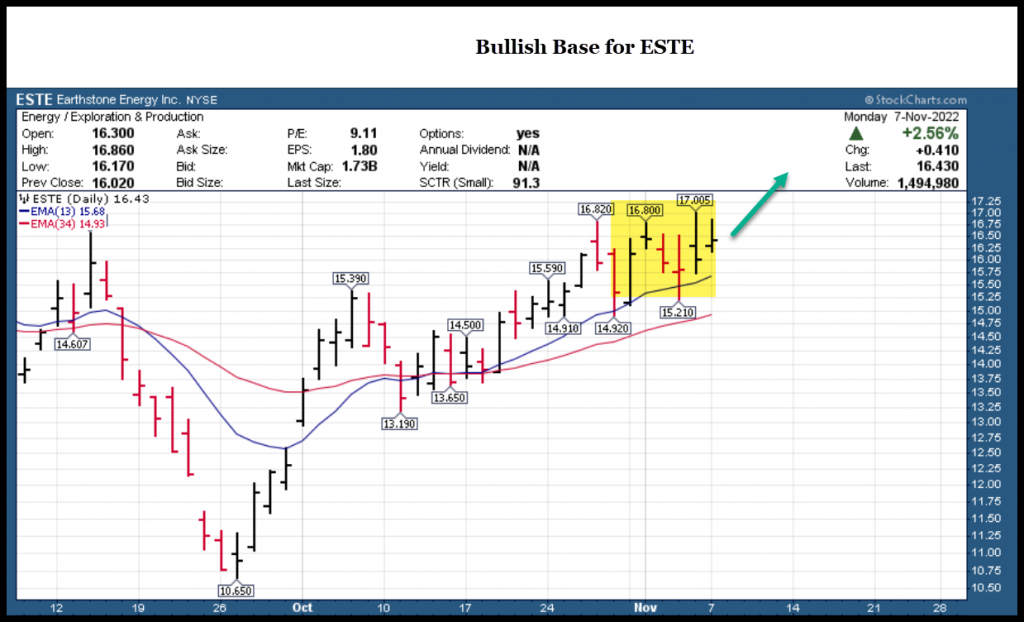

This morning charts on BIVI which could smash to upper 5’s and upper 6’s into early December Alzheimers conference, I continue to accumulate in buy ranges here. Update chart on ESTE and TALO also poised on paper to break out in the energy sector. Yesterday alerted a conservative (Hopefully) play with OXY also in the energy sector.

Positions: 5, 4 full positions and 1 – 1/2 position ( ESTE)

Trading Notes: Likely to issue 1-3 new position alerts this week market willing

ESTE 1/2, TALO, PERI, BIVI all full positions and all look good still see updated charts on ESTE, BIVI, TALO

BIVI we are holding for 4.70 plus before selling 1/2

If I issue a trade alert on Tuesday would be after 1030 am EST

OXY issued as new position on Monday

Swing trade ideas list is updated at bottom of morning report for more ideas

Hold all positions with stop near close in place and mind the 6% sell 1/2 rule when up 6% on any position with or without alerts as sometimes they move fast I can catch them all.

3x ETF Swing Trading just $40 a month with 70% plus success rate!

Closed out our ERX For 20% last week and we sold 1/2 our LABU for 8% as well! Make sure you are a member to get additional alpha and swing trade income opportunities. There is a definite methodology that works best for swinging 3x leveraged ETF’s and I’ve been doing it since 2008/2009 with success. Join direct on your desktop at stocktwits.com

TABLE OF CURRENT OPEN POSITIONS LINK: ONLINE LINK

Trading Results Tab ( View closed out trade results)

Current SRP Swing Allocation Model: 4 positions

If any swing trade is up 6% or from average entry, sell 1/2 of the position with or without our alerts, so bear that in mind. We will obviously do our best to get the alerts out on SMS and Email but just be aware of the SRP Rule going forward.

Swing Trades: Sell 1/2 when up 6% with or without an alert

Positions in buy ranges or close:

11/7- OXY, 10%, Max Buy 76.10 add to 72, Stop 69 Near Close, Target 84 plus

10/26- BIVI, 10%, Max Buy 4.20 add to 3.70 on dips, Stop 3.40 near close, Target 4.89 and 6.70

10/24- TALO, 10%, Max Buy 21.25 add to 19.75, Stop 18.75 Near Close, Target 24.50

10/21- PERI, 10%, Max Buy 23.25 add to 22.25, Stop 20.50 Near Close, Target 25.70-28

Out of Buy Ranges and/or Not Adding if we sold 1/2 on profit taking

10/25- ESTE, 5% Remainder, Max Buy 15.75 add to 14.60, Stop 14.10 Near Close, Target 17.90-20

1/2 Sold on 10/27 at 16.50 plus to 17.30 for 8-10% plus

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

11/6/22: Energy stocks still very strong updated list below

Updated list for the near term and intermediate window ahead based on sectors, individual stock fundamental strength, and Banister Behavioral Patterns lining up for strong probable upside.

CRK- Long base pattern here, on and off this list frequently. 10 week consolidation. Engaged in the exploration and production of oil and natural gas reserves primarily in Texas and Louisiana

SMCI- Breaks out of 9 week corrective base to highs then a pullback. One of the top growers in tech profit and sales wise. PE 9. Makes application-optimized server systems, chassis, server boards/power supplies for distributors/OEMs.

CCRN pulled back hard after great earnings late in week after hitting 40, back to 32’s. Could test low 31 area and may be an entry there. Provides staffing/outsourcing services, including staffing of travel/per diem nurses/temporary physicians.

CIVI- 3 weeks tight closings, looks close to a breakout in energy sector. Engaged in oil and natural gas acquisition, exploration, development and production in the U.S.

MRO- Close to breakout over prior June highs after multi month consolidation. Engaged in oil and gas exploration and production, oil sands mining and integrated gas services worldwide.

PARR- 3 weeks tight closings near highs. PE 4. Engaged in the refining, distribution and marketing of oil and gas,

commodity marketing

PBF- 5 week ascending base near highs. PE 2. Owns and operates Five oil refineries and related facilities located

in New Jersey, Ohio, Delaware and Toledo

LBRT- Close to a 6 month base breakout and 5 week ascending base. Provides hydraulic fracturing, wireline services to onshore oil, natural gas E&P companies in North America.

CPRX- 13 week overall base. SRP sold for profits two weeks ago but this still looks bullish. Develops prescription drugs for neuromuscular and neurological diseases and disorders. Earnings due Nov 9th.

AFYA- Volatile but now close to breaking out to 52 week highs. Brazil based Co provides medical and healthcare education through professional courses in 13 states.

OXY- Warren Buffet favorite, 10 week base, near a breakout and earnings this week. Engaged in the exploration and production of crude oil and natural gas worldwide. Cash flowing, stock buy backs, dividends…

DGII- Back on the list, 14 week overall base close to breakout. Manufactures connectivity/networking devices for telecommunication companies/internet service providers. Also one of fastest growing tech related names.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of nearly 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019-2022 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks have doubled or or better following Bear cycle low in March 2020 into Feb 2021. Constantly rotating portfolio with deletions and additions as time goes on. The New Bull Cycle started May 2022, good time to register now.

ESALERTS.COM $50 a month on stocktwits or Auto Trade Option $149 30 days or $349 90 days

SP 500 Futures Trading Advisory and Alert service. Hosted on Stocktwits.com and or Auto-Trade platform with my partner trading firm… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Trade Micro-Mini’s which are about $2,000 per exposure per 4,000 SP 500 pricing per contract. Reasonable Risk, high upside, and tax favorable.

Contact Dave with any questions (Dave@themarketanalysts.com)