07 Mar Markets Forecasts and Stock Ideas Report- 3/7

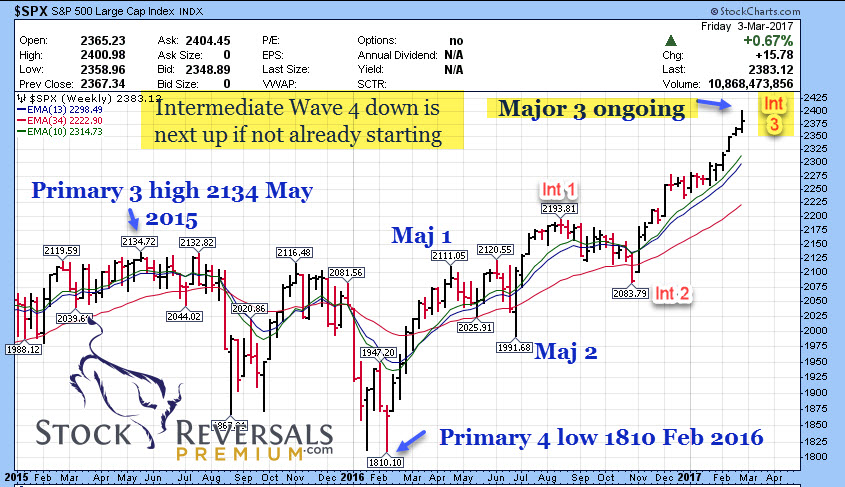

We have been calling for a correction to the 2326-2333 area since last week. The 2401 area was within 5 points of a target we placed back in late November in our SP 500 Forecast models. We update these every Sunday in our member reports as well.

If you are not yet Opted In as a Stockreversals.com Member, consider getting on board today. Are you ready for something different? Forecasts, Trade Ideas, Long Term Growth Stock reports, and more.

Sign Up with Name and E-mail, we do not share your E-mail address with any entity.

Near term the 2364 area will fill in a gap in the charts and test the 13 day EMA line, but risks remain to the 2326 area as a typical minimal retracement for a Wave 4 corrective pattern

Biotech: XBI ETF under consolidation

Last week we pointed out 69 as an area to watch for a pullback in the Biotech sector ETF , XBI. So far working in that direction with a clear pivot at 68.60 area

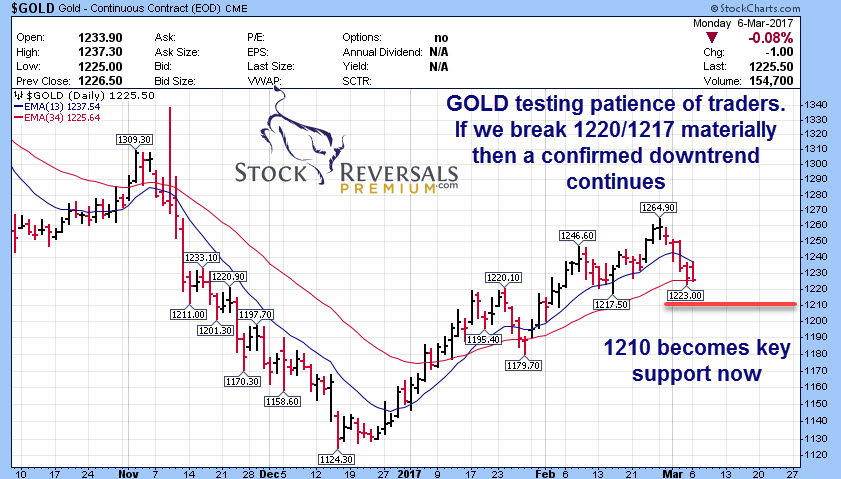

GOLD- Issues at 1217-1223 as key support

Gold has been downtrending after breaking key 1236 pivot support, we now have 1210 lined up if this 1223 area does not hold.

Stocks of Interest: NBEV, VUZI, ADXS

NBEV

In our last report to SR members we discussed NBEV as basing at $3.50 and a good spot to enter. We first recommended the stock to SR Members in 2016 at $2.71 per share in a full write up. The stock doubled and then some in the following months, did a financing at 3.50 recently, and now appear back in an uptrend. This healthy beverages maker is making waves.

VUZI–

The Augmented Reality glasswear maker may have a 2017-2018 turnaround. A recent joint venture with Toshiba may have turned the tables on the stock. It bottomed at 5.35 about two weeks ago. Extremely volatile stock, not for the feint of heart.

ADXS- Watch gap fill at 8.80, higher risk play

This controversial Biotech came back to earth stock price wise in 2016, however may now be attempting to break out of a long base pattern. A recent tie up with Amgen sparked the shares higher and developments are gaining traction into 2018

*We have a position in VUZI at the time of this article.

This material should not be considered investment advice. The Market Analysts Group, LLC, StockReversals.com and any of our affiliates are not a registered investment advisor. Under no circumstances should any content from this website, articles, videos, seminars or emails from Stockreversals.com or Stockreversalspremium.com or any of its affiliates be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only. Disclaimer:

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.