20 May Free Stock Swing Trade and Market Forecast Report

Join Free with Name and Email to get updated Forecasts on SP 500, Gold, Oil, Biotech and more plus IPO reports at Stockreversals.com (twitter @stockreversals)

stockreversalspremium.com – Swing Trade service

Tippingpointstocks.com– Growth Stocks with 50-200% upside

Free Stock Swing Trade and Weekly Forecasts Report: May 20th

Consolidation week during Options Expiration week this past week in the SP 500. We should be in Major Wave 5 of the bull cycle here with a 3020 target on the low end. 2686 area is a first pivot support if we pull back some near term.

Updated long term SP 500 Weekly Chart: Major Wave 5 up underway

SP 500 Daily Chart: Watching 2686 pivot area, above downtrend line

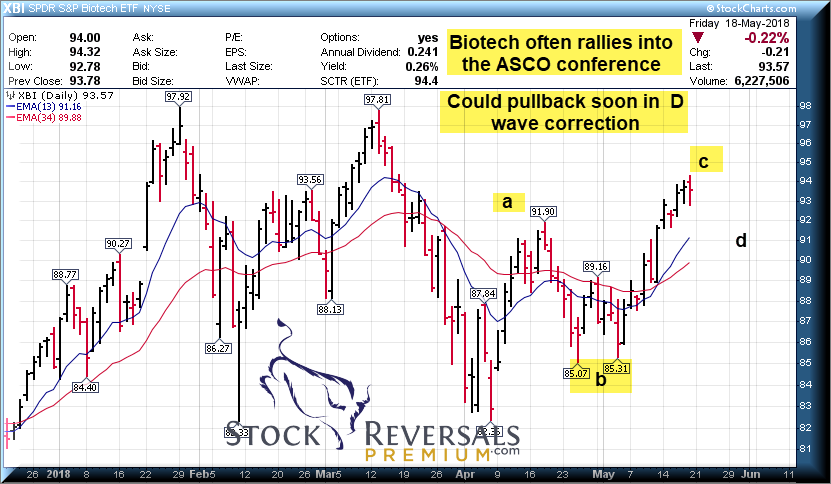

BIOTECH Update: XBI ETF shown in chart below.

Typical rally ahead of ASCO conference that is coming up which is June 1-5th in Chicago. A pullback in a D wave possible ahead though.

GOLD Update:

Gold as we know was unable to break out of either the 5 wave triangle or the cup pattern we pointed out weeks back. The US Dollar picked up as interest rates rose and Gold got sold off. That said, the long term uptrend line is intact as we show and at loose 1289 area is pivot support, plus minus 5-7 points.

Swing Trading Thoughts: Opex Week and Stops

Options Expiration week on a stock by stock basis tends to be very volatile, we used to say “Friends don’t let friends trade OPEX week”. Crazy action in BZUN which was on our weekly swing trade list last Sunday, dropped to 44, closed over 54 by the end of the week up 11% for the week. Many quality names will pull back on no news during OPEX week, giving opportunity to enter or add for stock reversals in the week following.

Keep in mind as a swing trader, frequently the volatile action you see over the short term is algo related, stop losses running, computer trading, trend following etc. We saw this in IQ a few weeks ago dropping from 19 to 15.80 and then to 23 all within 7-9 trading days. We held it under 16 and then sold out at 19.50 and 22 ranges for nice gains on each 1/2 of the swing trade.

BILI is another Post IPO Base we wrote about at 11.40 area, it then dropped from 11.50 to 9.90 and then to 14.15 all within a 10 day window as well. We got stopped out of that one under 10.50 only to watch it eventually soar higher the following week, you win some you lose some. We use stop losses near the close of the market day to try to avoid intra-day stop loss washouts, but you still have to place your relative risk stop somewhere.

Swing Trading requires discipline and you have to try to work your way in on dips, but also place a strategic stop loss so you don’t get stopped out on noise and computer trading either, often this is tricky to pull off. During OPEX week, its very difficult to keep that in mind if you are a swing trader, so do not get too frustrated if you fell victim to the craziness last week on any of your trades.

We had several stocks perform quite well off the Weekly Swing Trade Candidates list, BZUN up 11%, DQ up 17%, GOOS up 10%, PGTI up 9.4%. Since we can’t alert 10 trades every week and try to track them all, we push out a list every Sunday with our best ideas. We alerted 3 stocks at SRP this past week and are looking to add more positions this week.

Tipping Point Stocks Update: We are opening up Tipping Point Stocks for a few new members as we are at or near full capacity of members. We expect to have our next Growth Stock Research report out on Monday or Tuesday this week. This company recently went public quietly and has 75% insider and 11% strategic investor ownership post IPO. Leaving about 14% for the retail investors and based on the 2nd half of 2018 strategic plans this could push this Tipping Point Stock much higher by year end for TPS subscribers. Read up at TippingPointStocks.com

12 Swing Trade Candidates: Each weekend we try to list out 10-18 fresh ideas for possible breakouts or stock reversals ahead. Last week we had multiple winners and this week some repeated names and a few fresh ones as well. We use this to consider ideas for SRP Alerts and to provide more ideas for our members!

SEDG- Often on our list of late and it has been working higher. Near 52 week highs, Solar Inverter maker

TAL- 2 weeks tight base near highs for K-12 after school tutoring company, has been on list often.

TTGT- Strong uptrend, data driven advertising services for business to business technology vendors

CPRT- Pullback after breakout of uptrend. Often on our list lately, Salvaged Vehicle auctions

MU- Pulling back to 10 week line after breakout off our list, DRAM and Flash memory maker

WRD- 5 week ascending base and pullback for oil and gas exploration company

YY- 4 week ascending base after 3 month corrective for Chinese Online Social platform

SGH- Pulled back hard 7% last week off our list, electronics sub systems provider

ZTO- Ascending Base for Chinese provider of parcel delivery services

HCC- 3 weeks tight base near highs for Coal producer, often on our list in the past

CPE- 5 week base pattern for Oil and Gas operator

GNK- 2 weeks tight pattern near highs for Shipping carrier for commodities

Stock and ETF Swing Trading and Elliott Wave Forecasts

Membership Subscription service with real time buy and sell alerts, full informational posts on each position as alerted, morning pre market reports with updates on the markets and all open positions, 24/5 access to our Chief Strategist, Tutorials and more!

Join today! 72% Success Rate since inception September 2013

Get 30% off a Monthly or Quarterly subscription using Discount Coupon Code: PSFFT5NWT1

sign up here (Click to Register)

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analysts)