28 Feb Weekly Forecast and Opportunities Report

SRP: Swing Trades with less risk, less stress, and high returns. SMS Text, Post, E-mail, and ongoing morning updates and sell alerts after we enter. Forecasts that are spot on and updated daily in pre-market for the SP 500, Gold, Biotech, Oil, and more. Check out our 77% accuracy track record and much more at Stockreversalspremium.com

Is the market finally approaching an interim top?

Everyone thinks they are a genius in a 3rd wave…but you better know where that terminal turn pivot is and prepare

This past week the SP 500 managed to hit our projected 2362 pivot and now we are looking square in the eye of our 2406 projection made a few months ago when that seemed a bit outlandish to predict. We had suggested to SRP members and that a “3rd of a 3rd” pattern was developing after the election. These patterns are considered the most bullish in Elliott Wave theory for uptrends, and or downtrends. Therefore, we assumed a 300 point rally from the 2083 Wave 2 low was possible, and now here we are knocking on that door.

While many Bears have been trampled trying to call a top along the way up from 2083, we have stayed with the trend knowing that a rally to the 2400 area was quite possible if this indeed was a 3rd of a 3rd pattern. Now what we do is look for evidence of an interim top as we climb.

To back up a few steps, a bullish or motive wave pattern in Elliott Wave Theory is made up of 5 full waves of varying degree. To keep it simple, Waves 1, 3, and 5 are up and Waves 2 and 4 are corrective. We are in the 3rd wave up, and within that are 5 waves… and we are in the 3rd wave of those 5… hence “3rd of a 3rd”. As we approach 2362 and 2406 targets we want to look for evidence of a confirming high. This prepares us for a correction in advance and we are simply now looking for confirmations.

So other than 2406, here are a few things we are noticing as we approach that level:

- The Snap Chat IPO is this Thursday, seems suitable to happen at the 3rd of a 3rd high to us.

- Trump has a congressional session on Tuesday where he may outline more of his agenda

- Tesla and Nividia, some recent leaders took hits this past week

- Chinese stocks retreated this past week

- Traditional chart indicators such as RSI, Stochastics, and more are at typical high or peak levels

- Sentiment is running very hot at 62% Bulls to 17% Bears in Advisory surveys.

We expect a 60-100 point SP 500 index correction once Wave 3 of 3 is confirmed at a high, but then we still have Wave 5 to the upside likely after that. Then we have Major Wave 4 and Major wave 5 as well, so we are not calling a Bull Market top here, just approaching an intermediate top with a March correction feeling likely.

Weekly and Daily SP 500 charts below:

Small Caps: IWM ETF 12 week base

GOLD Update: $1329 next?

We got past the 1250 resistance level we outlined in our Feb 19th Forecast report, and we said 1329 would be on deck if so. This is now the number we are projecting as an interim high in the weeks and months ahead

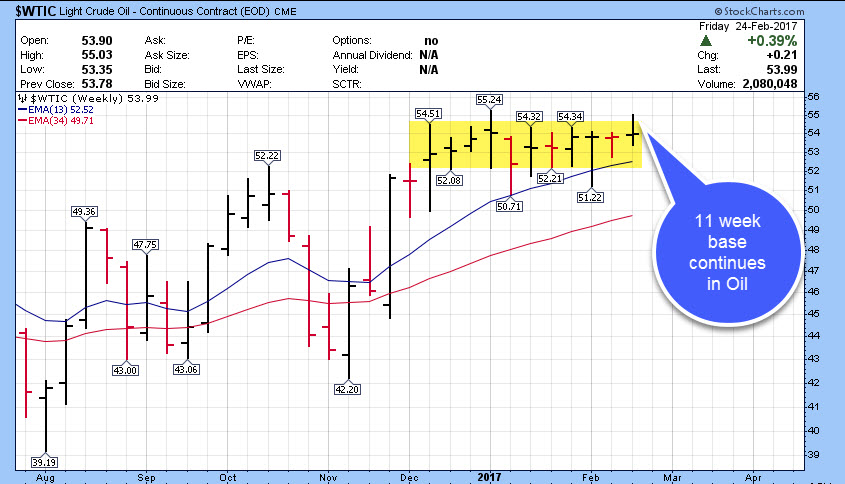

Oil Update: 11 week base continues

Oil needs to break out over $55 in US Dollars to confirm a new uptrend. In the meantime we had Oil hitting 19 month highs this past week before backing down. The XLE ETF however did not respond and went south, which for now is not confirming the attempt for Oil to break out. We remain on sidelines on the ERX ETF until we get a confirmed breakout in Oil

Biotech Update: Pullback for now is normal

Last week we discussed a 70-73 resistance band for XBI ETF being a problem near term. Sure enough we got a pullback to the former 66.50 pivot area, which was tested twice late in the week, then closed just over 67. XBI continues to consolidate nicely and we are on the sidelines in terms of 3x ETF trades right now but monitoring LABU again closely. Would like to see that $65 area hold for sure on XBI.

Daily chart below shows pullback in to the mid 66’s as SRP Members were advised to watch in advance. The weekly chart below this shows a normal pullback after the 5 wave triangle breakout attempt.

Market thoughts and comments:

Restaurant stocks were down this past week

Banks, Chips, Chip Equipment, and Optics stocks continue to lead

Infrastructure stocks rolled over on concern about a delay until 2018 for a Trump led spending bill

Dow is up 11 days in a row, most in decades, typical of a strong 3rd wave pattern

Chinese stocks retreated some after torrid rally, including NTES, MOMO, SINA etc.

Tesla and Nividia were down, some recent leaders…watch the Generals for clues

Some of our tenets and thoughts on trading:

A great swing trade requires balance, order, rhythm and harmony. Focus on those elements with every trade

Most day traders will end up on anxiety medicine and an empty trading account while the swing traders are at the beach

When you are high fiving yourself in the mirror on a trade…sell some

Keep the same buy and sell disciplines on every trade. Don’t get cute or start thinking you are smarter than the market. Stay calm.

We set a swing target objective on every trade…but we almost always sell half on the way there. Manage your risk and your stress levels

When we close out a trade we literally delete it off our Watch list immediately. Never sit around with what ifs…just move on

Opportunities:

This is the section of our Weekend Forecast and Opportunities report where we lay out some ideas and watch lists.

At SRP we prefer not just a good looking technical chart pattern, but also strong fundamentals at the same time. So we may miss a few of those momentum runners here and there, but we rarely get caught with our pants down on the fundamentals side. Year to date we have closed out 22 of our 26 swing trade tranches for profits, and have sidestepped major hits. This past week IDCC is a good example, down 13 points, but we sold it the week prior for gains sensing a top in both the chart pattern but also the business cycle side. IBD was pushing the stock a week ago in an article, and that is why we sold out. We have raised cash balances to fairly high levels as we approach the 2406 pivot area, but that doesnt mean there are not areas to make money still.

Here are some fresh Watch List ideas for further consideration: 16 Stock Ideas

AEIS- 4 week base pattern, on list multiple times. Power conversion business, PE ratio 20

THO- On list last few weeks, 3 weeks tight pattern for this recreational vehicles play

ESNT- Off and on the list over last few months, had a big run and now pulled back. This mortgage sector play has key support at $34

HQY- Another that we have discussed as a fast grower. One of the bull themes assumed a makeover of the Obamacare plans, and that would lead more High Deductible and therefore HSA accounts which HQY excels in. Stock has pulled back hard as these plans to alter or delete the Affordable Healthcare Acct have slowed down, but may present opportunity in HQY

CRTO- Digital Ad technology firm that has been frustrating quarter to quarter for investors finally hitting 52 week highs

GDOT- Green Dot nearing highs, a provider of pre-paid debit cards and more

AMN- Provider of nursing and medical staffing services, 42-44 is resistance area on 52 week chart

RDN- Also in the mortgage area for insurance, as support line $18 being key

TAL- Forming a handle of a cup and handle weekly chart. Chinese education provider

BABA- forming a 5 week base pattern at 102 area

PWR- 5 week base pattern for this Engineering advisory firm. These companies in high demand.

OLLI- mentioned recently as one of the leading Retail stocks in our Weekend Reports

TTD- Doing a secondary offering non dilutive, one of our favorites in the advertising space

ATH- 3 weeks tight pattern, near IPO highs for this Financial products and services recent IPO

BIVV- Spin off of Biogen, $325 million in cash and positive earnings from two therapies with ramping revenues. A pullback would be nice to enter

GTN- Broadcast stocks are hot, $14 resistance