16 Mar Cool Tech Research Report

This Research was published at TippingPointStocks.com on 3/16/21 for Paying members. This is a private link being shared with my permission- David Banister, Chief Strategist, Themarketanalysts.com

Cool Tech – “Take Power Anywhere”

Website: Cool Tech

WARM: OTCQB- Not yet listed on NASDAQ, possibly later this year.

Current Stock Price: .06 cents per share, 2021 target 20 cents or 3.3x 2022 target 82 cents or 13.6x potential

488m shares outstanding or 29 million market cap at 6 cents.

Max Buy .08 cents

USE LIMIT ORDERS

- 12 month LOW END target is 3.3x the current valuation on the low end or 20 cents per share using 25 million in 2021 revenue, likely very high margins assumed and a small multiple.

- 21 month target is 4oo million market cap or 82 cents using 100m in 2022 revenues and high assumed margins, at a small multiple

At 6 cents a share, this is a penny OTC listed stock. I normally would not recommend a “Penny” stock, but GBOX was last August at 12 cents on the OTC as well, now the equivalent of $2.20 or a near 20 bagger for early investors. WARM has the same opportunity if I’m right. Some of you may not be able to buy on your platforms. Likely this symbol will work with Fidelity, Ameritrade, perhaps a few others. If you can’t buy it, change platforms as the move now is to see up lists from OTC to NASDAQ or NYSE and you may miss out on some future winners. – Dave

An intellectual property company focused on environmentally friendly mobile power generation and heat removal technologies that can be retro-fitted on existing truck fleets worldwide.

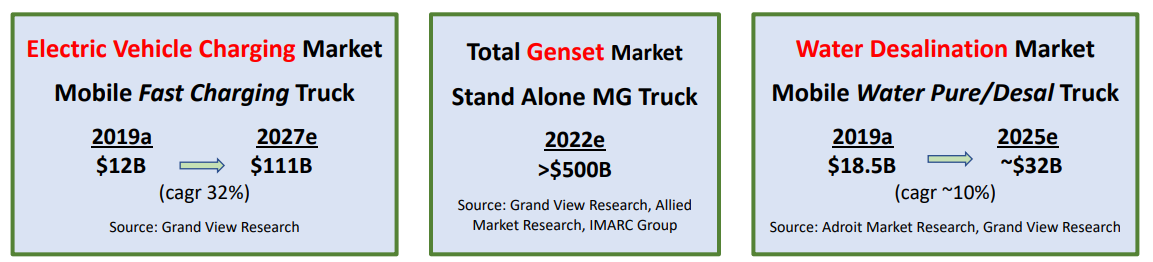

A play on Electric Vehicles, Charging Technology, and remote power generation. Hitting 3 hot sectors of the market. A Tipping Point to invest as they are exploring the possibility of raising capital via debt financing or some form of non dilutive financing, and hopefully start fulfilling a large backlog of orders to retro-fit truck fleets with their various MG technologies. Likely very high profit margins on every order due to the I.P. and their control over pricing and orders.

Water Desalination in the Field (Can be equipped on any truck with 14,000 gallon capacity)

Remote EV Charging with fast charge technology (Think AAA for remote charging needs)

Remote instant Power Grid to power up entire neighborhoods or other power needs remotely (Think Texas disaster)

Heat reduction and horsepower improvement for existing truck fleets

MG competes with all power generator/generation markets and disrupts several more. Current competitors if you will can easily turn into customers. This company is at a Tipping Point of investor and industry recognition. Soon they will commence production of their retro-fit patented technologies for existing fleets of trucks that are and can be deployed in the field. An exploration of possible debt financing could initiate orders of a backlog of 100 million and growing, and the shares should appreciate rapidly as investors take note. Good time to get in while it’s still under the radar- Dave

Management: (The Board of Directors is loaded with industry experience)

CEO: Timothy Hassett

CEO, Chairman & Co-Founder, he learned under Jack Welch and his famous six sigma management methodology at GE.

30+ years experience managing and growing manufacturing firms

• GE, WaveCrest, Hawk Motors, Rockwell Automation

• Worked for Jack Welch at GE to turnaround two divisions

(Distribution Services & Motors)

• Took WaveCrest from $0 to $30M in revenues in 18 months (with Mark)

• Took Lemo from $32 to $75M in revenue and grew net income 22x in 4

years

• Mars Rover drive train co-designer(with Mark H.)

MG (Mobile Generation) is an Add-on Option for Work Trucks, New and Used with no tow-behind generator, the truck is freed up for use into new market opportunities and or new types of utility vehicle applications that were not previously possible.

- CoolTech’s Mobile Generation System (MG) takes high power anywhere for mobile EV charging, natural

disasters and any work that requires power…just plug into the truck - Mobile EV Fast Charging- Fast Charge up to 6 Electric Vehicles anywhere

- Power Neighborhoods or businesses during natural disasters by plugging right into the grid

- Bring Water Desalination capability into remote regions

How does one get power into the field?

• Until now, mobile power required a trailered generator. These generators require extra trucks, equipment,

security, and expensive government required maintenance

• CoolTech is the ONLY way to bring industrial amounts of power into the field without a trailer for welders, pumps and other equipment

• fast chargers for electric vehicles (think AAA)

• first responders

• electric or gas utility service vehicles – plug into the grid and power entire neighborhoods

• FEMA, disaster relief and the military

• agricultural needs (irrigation pumps etc)

Business Model

- CoolTech employs a blended licensing and manufacturing partner model to garner high

margins while driving sales

- Joint Venture Partnerships with sales organizations – Supplier markup & royalty

- Final Assembly/Upfitting partners – Supplier markup & royalty

- MGs are sourced in components into for delivery to:

Truck OEMs or Vehicle Upfitters – Markup or license & royalty

(Mobile Power Generation) MG Trucks An MG is a Truck with built-in High Power, or On Board Power for Work

• 30 to 400 kVA power (Capable of very high speed charging)

• UPS – Uninterruptable Power Source

• No-idle system

CoolTech’s Thermal Dispersion Technology Platform:

Removes heat from rotating equipment (motors and generators) faster and more efficiently than legacy

methods. This means improved Power Density which allows manufacturers to do two things:

1. More Power Output: build machines that put out 20% to 40% more power (horsepower or electric power)

2. Lower Costs (COGS): lower manufacturing costs by building smaller machines with the same output as the original machines

Intellectual Property:

- 10 Issued Utility Patents (Global PCT and US)

- The IP leverages a unique ability to increase power density and lower manufacturing costs in the

motor/generator/pump (and other) industries

Competitive Advantage:

- MG can take high power anywhere a truck can drive

without the need to tow a generator - With MG power built-in, MGs are not subject to

expensive government regulatory compliance required

for tow-behind generators - CoolTech’s thermal technology can help manufacturers

lower costs and gain a competitive advantage in both

cost and machine size

Massive opportunity:

In working on this research report, I spoke with various people who are involved with Cool Technologies (WARM) . This is a classic small technology company that is disruptive to their specific industry, have a strong patent portfolio and engineering and success with their product or technology and wide total addressable markets at scale.

Often small technology companies need help to structure the IP with top patent law firms, and then arrange financing and also gets the share structures tightened up with reverse splits for example like GBOX recently, and up listing or IPO plans get put into place. Hopefully Cool will follow this same path going forward and we are investing early on.

Initially the company was mostly made up of brilliant engineers and not necessarily finance people. As time has passed, Cool has been able to develop a very strong and experienced board of directors with strong career success backgrounds. Cool now has a finance person on the board, and a finance firm helping to put the ducks in a row. I would expect that Cool would consider the possibility of the use of a reverse split as we have seen with GBOX and BIVI and VIRX, and perhaps possible debt and purchase order financing now so they can begin to fulfill a huge 100 million backlog of orders.

The idea with debt debt financing is to avoid common stock dilution as each order has a likely strong margins and essentially all the work is outsourced. This is an “Asset light” Model if you will. Cool can then can start to ship materials to their OEM partner who will retrofit the trucks with the MG technology depending on what features the customer orders. Cool can also potentially explore potential purchase order financing which also would help . Customers so far are cash payers and not debt or loans to buy so the credit rating of the orders is very high.

The margins can be significantly higher than the automobile or truck market on each truck completed relative to the build out pricing models due to their control over the I.P. It will take about 12 weeks once they are funded with financing for the first trucks to start the build out, then each truck only takes a few weeks to complete. As they work through the backlog, cash flows will move higher and the stock should follow as quarterly results continue to move higher and investors catch on. Later on, perhaps a possible up list to the NASDAQ would make some sense which can attract more investors and provider for growth financing. This usually requires a working capital raise at the same time to meet NASDAQ requirements as we saw with BIVI and GBOX. The shares can likely continue to appreciate as they tackle more opportunities which are nearly unlimited in scope in my opinion.

The technology is excellent and the orders are real. The CEO has had to tap dance around for months as they work on financing to get production started. As noted above, there are 100m in orders right now for the trucks so the sooner they can hope to obtain financing the sooner they can start to fulfill orders and add more.

Valuation: 5x-15x return in 12-24 months possible

There is potential to deliver 25 million in orders in calendar year 2021, at a strong margin that’s I would estimate 12.5 million of EBITDA or cash flow. If we take a 10x on cash flow multiple, that would put the valuation at 125 million. Currently at 5 cents per share the valuation is about 25 million. We could see a 5x return between now and 12 months out for potential upside.

If we look out to calendar year 2022 and assume no more orders or new business, which is highly unlikely, we can ship another 75 million to 100 million plus or production revenue in 2022. Using strong potential margins assumed is 37.5 million to 50million of cash flow, 10x that lower number is 375 million and 500 million on the high side. If they use debt financing and purchase order financing, there is no common stock dilution other than perhaps a capital raise if they up list. Using 375 million as a marker for valuation in late 2022, we can come up with a target of .75 cents per share, 13x the current valuation.

Even if you take my numbers and cut them in half, we come up with 2.3x return in 2021 and up to 6.5x return by end of 2022 from current 6 cent pricing assumptions. This assumes no further orders or new business, so at these levels we are certainly getting in at an extremely low valuation of just over 1x 2021 sales and 2x cash flow assumptions.

COOL has a great suite of products. The various target markets include governments, oil field servicing trucks, construction operations, severe weather, power outages, remote electric truck and car portable fast charging etc. Some of the current orders are coming from the countries of Turkey, Mexico, and the US Government, State of California etc. The business model is extremely scalable as they have a joint venture with an after market manufacturer in St. Louis. They use a Ford F 150, 250, and or 350 truck chassis and integrate into chassis of the vehicle, and can obtain likely high margins when completed depending on feature sets chosen by customer.

The high speed mobile charger for use in the rural community alone is a big opportunity. As one example, setting up charging stations you read about like the Tesla stations is a large and expensive and time consuming process. For just 300-400k of cost to set up a truck for mobile charging, Cool Technologies can charge 2-6 cars at a time, and less than 20 minutes for a full charge on a low grade example of a truck for a city or town etc. This market could bloom quickly, as an example British Pete is going all electric vehicles by 2030 in the field, so this is a great field services infrastructure play alone let alone for consumer potential. Electric truck and or bus integration is ongoing now in many industries.

Tim Hasset is the CEO, from Jack Welch training if you will at GE. The company has a great suite of products. Target markets are governments, oil fields, construction operations, severe weather, remote power charging etc. Turkey, Mexico, the US Government, California etc. are where orders are from. The upside is unlimited going forward if they execute, this is the Tipping Point to invest if I’m right.

Advice: No TPS stock should be more than 8% of your allocated TPS portfolio dollars, position sizing is important and we want to keep risk adjusted model intact.

Buy up to 8 cents per share, and if the market or the stock dips plan to add down to 4.5-5 cents per share. If it pulls back after the split, I can advise on adding as well. I am looking for 20-80 cents per share equivalent in 9-21 months from the current 6 cent pre-split and pre up list pricing. Think of GBOX which was 12 cents on the OTC last summer, would not be about $2.16 per share!