20 Nov Market Forecasts and Trading Ideas Report

Publishers of Stockreversals.com (Opt in Free)

Stockreversalspremium.com a Swing Trade and Forecast Advisory service

TippingPointStocks.com a Long Term growth stock advisory service aiming for 50-200% gains per position! Just launched October 4th 2017! Join now at Charter Member Rates!

If not yet a StockReversals.com Member, opt in free today to get our free reports and intra-week updates!

After a corrective pull back over the last 6 weeks in the Biotech sector, and a correction in the Small Caps as well, the markets finally saw a dip in the large cap indexes as well. However, for now the pullback has maintained support for the SP 500 at the 34 day EMA line which we use often for lower end support in our forecasts. A rebound late in the week on news of Tax Reform pushed the indexes back up but not yet to uptrend highs.

We also note the Mid Cap stocks have been consolidating for several weeks in a range and have a chart on the MDY ETF to review this week.

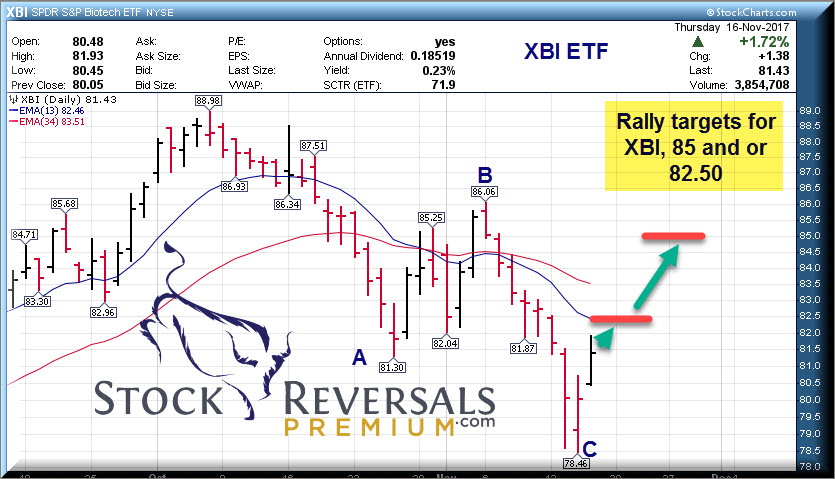

Biotech had a clear ABC correction using the XBI ETF as our guide and may push a bit higher as well.

The IWM ETF for the small caps also bottomed near a Fibonacci pivot at 144.50 and has bounced.

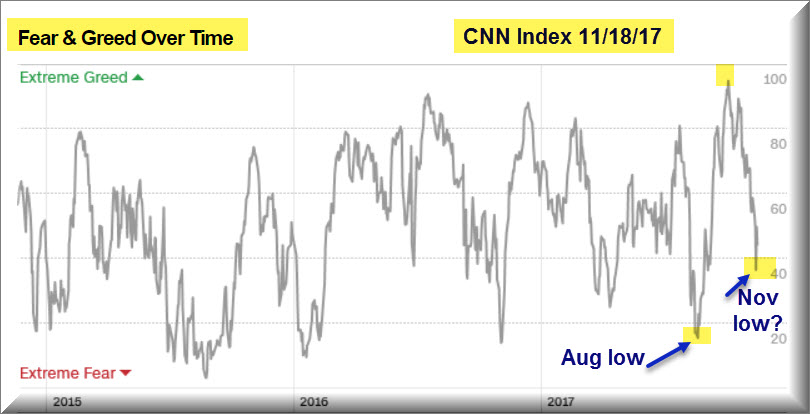

We are coming into a seasonally strong period for the markets with a shortened week in the US with the markets closed on Thursday and likely quiet on Friday this week. The CNN Greed and Fear Gauge indicator has fallen sharply into Fear territory as we show in a chart this week. In addition, the NYSE percentage of stocks over 50 day moving average may have bottomed at 46% this week down from a high reading of 79% in October.

Finally, Gold bottomed and broke past the 1287 line we said was key for a rally to 1309 target.

Below we have some charts to sum it all up, the markets could set up for a Holiday rally into year end.

SP 500: Weekly chart shows 5 day consolidation 2540 key support

MDY ETF: Mid Cap Stocks: 7 week base, holding 13 week EMA Line

IWM ETF: Small Caps bounce up off Fib retracement and gap fill

XBI ETF Update: Biotech ABC Bottom?

GOLD update: Rallies past 1287 resistance, 1309 on tap

NYSE % Of Stocks above 50 day MA line may have bottomed out: November lows at 46% vs 39% for August lows this year

CNN Fear-Greed gauge may have bottomed as well:

Market Notes:

Retail sector all of a sudden is strong. Walmart, Nike, Foot Locker, Restoration Hardware and more moving up.

Tax Reform is progressing giving market a lift , a lower corporate tax rate is bullish if passed

Advisors are still at 63% Bulls and only 15% Bears which is at the extremes contrarian wise

NYSE short interest is still declining

Swing Trading Sample: YY

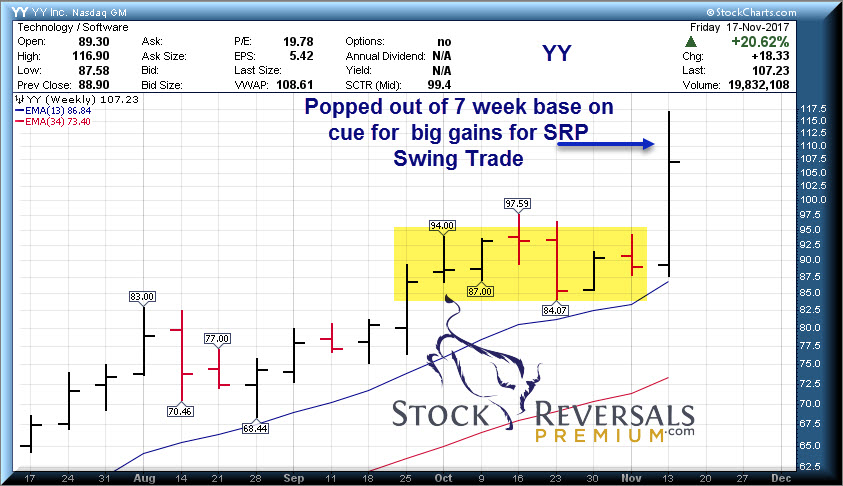

The YY Trade at SRP gone mad! $90 to $117 in 24 hours!

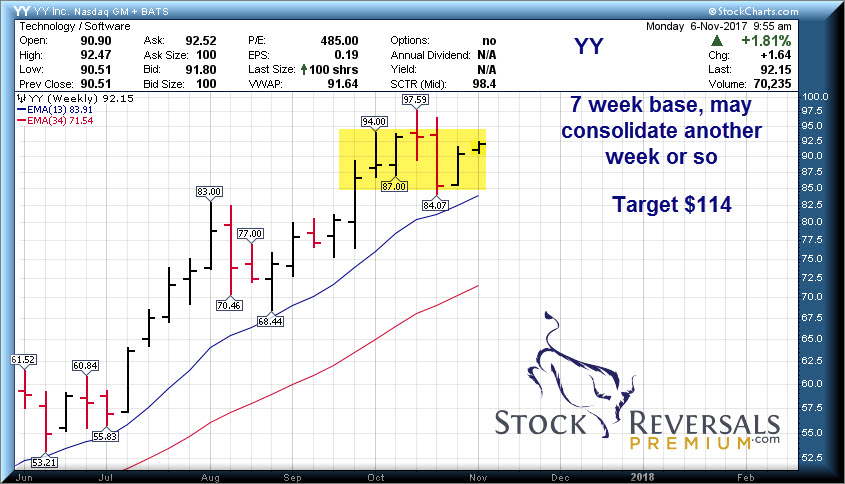

We had a nice swing trade on Chinese internet company YY alerted on November 6th with a buy range from 89-92 suggested and a target of $114. This was a lofty target but was based on both our fundamental analysis as well as the chart pattern. We often like to find Swing Trades where there has been a nice base building pattern in the chart and it lines up with a catalyst ahead and or strong fundamentals.

YY reported earnings this past week and within 24 hours the stock ran from $90 to $114, hitting our target in short order and allowing us to bank as much as 17% gains by the time we closed it out around $107.

Looking for consolidations and base patterns, then entering correctly and being patient is a key to swing trade success at SRP.

Below is the YY alert chart which we entered during a 7 week base period with 89-92 advised buy ranges

After the 7 week base and earnings came out, we get a pop from 87 lows to 117 highs!

Swing Trade Candidates:

Each week part of our preparation and work is to identify 10-18 names that are attractive, list out some notes, and then drill down further during the week to Alert some of them if they fit our criteria. Since we are not going to alert 18 trades a week (Usually 1-3) then we like to share this list with our subscribers to give them more ideas.

Last week our list was small but had YY on it, and we owned it at SRP and benefited as the biggest gainer of the week.

We like to also list a few “Post IPO Base” trading ideas as well as these patterns can lead to big gains as well:

Post IPO Base Ideas:

JAG, RYB, SOGO, MFGP, AYX

14 Swing Trade Ideas:

ICHR- 6 week corrective base pattern, near the 10 week line. Chip Equipment/fluids maker

BABA- 10 week base for Alibaba, the Chinese e commerce giant

AMAT- Chip equipment king in a 5 week base. Earnings came out and it pulled back

CTRL- Frequently on our list as it has climbed steady, 3 week ascending base. Automation for home

FB- 17 week base now for Facebook, will likely break out soon

AEIS- 3 week corrective pattern for Solar related manufacturer

PRAH- 3 week corrective pattern and a bounce over 10 week line for Clinical services provider to Biotech sector

BGCP- 7 week corrective base, Global Brokerage

GWRE- 11 week base near highs, insurance industry software that helps P and C companies increase margins

TRHC- 8 week base breakout this week, software helps to prevent side effects from drug prescription combinations

LGF/A- Lions Gate Entertainment- 12 week base pattern

MB- 4 weeks tight pattern- MindBody provides gym management software

MKSI- 4 weeks corrective base pattern

SRP Update:

This past week we closed out YY for 17% gains and issued a fresh alert on Monday that was up as much as 15% within a few days.

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analyst)

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com