02 May Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of May 3rd 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

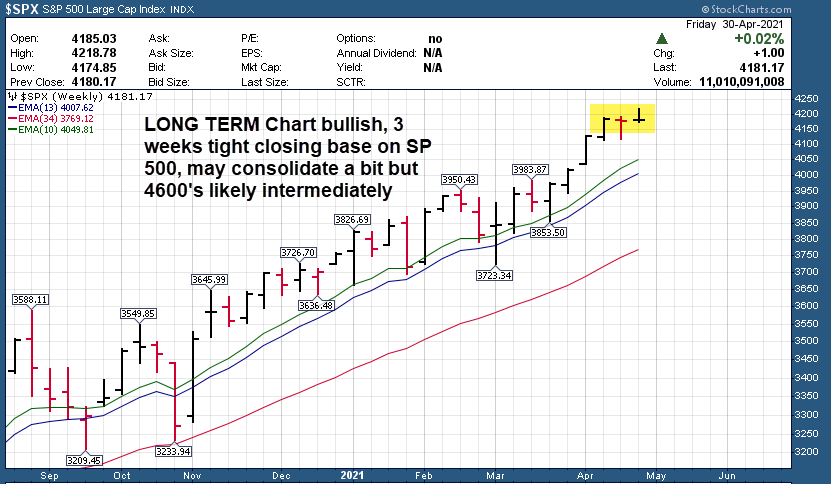

- 4218 high last week, have not yet hit my 4240-4280 projections (Chart)

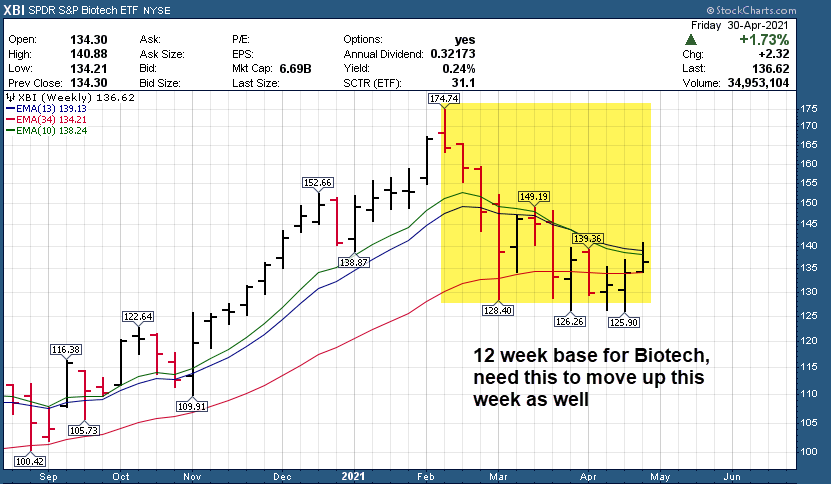

- Biotech pulled back last week after recent pop up (Chart)

- IWM 12 week overall base, would like to see it move up this week (Chart)

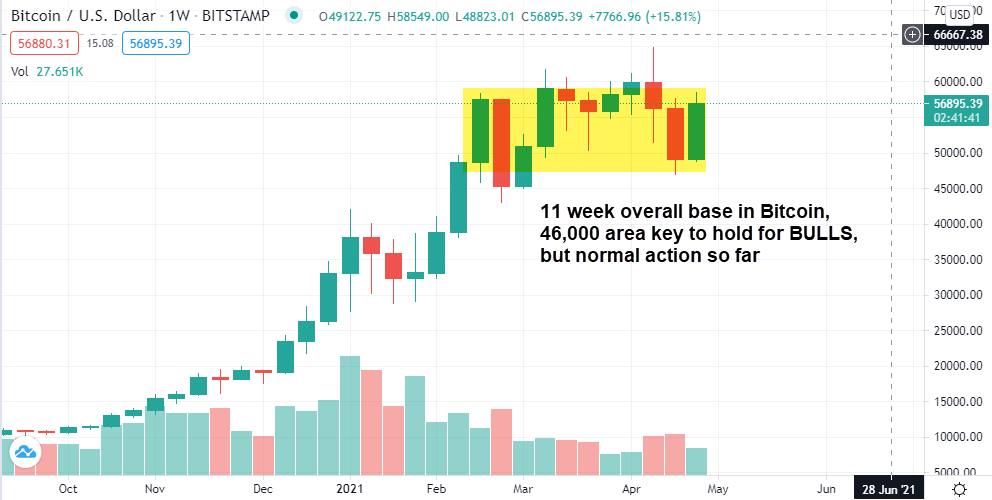

- Bitcoin hit my 65,000 target and corrected. 46,000 key support (Chart)

Recent results: 3x ETF service closed FAS Bull ETF for 11% plus gains and issued new alert. SRP closed out CRCT, GRBK for gains and issued new alerts. TPS is close to issuing new research report position, and each one aims for 100% plus returns. ES Futures service continues to make dramatic profits on trades.

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

SP 500 in a 3 weeks tight closing base pattern. Consolidation is healthy but we are near top of the range. A pullback late last week is normal after a recent surge. SP 500 likely works higher intermediately as old economy stocks can take the reins. Small caps are in a 12 week base along with a Biotech 12 week correction pattern, and both I would like to see move to the upside this week for Bulls, if not could be concerning at least for those segments of the market.

In general I remain bullish, but I did move the stop to 4165 on ES Futures in the futures service on Friday to protect profits from a 4145 new entry. Also we closed out FAS (3x Bull Financials) which was going a little parabolic late in the week and we took some nice 11% gains there in the 3x ETF service before the pullback Friday. I have also closed out several positions in the TPS long term service over last few weeks as we raise cash and look for new opportunities. Bitcoin is well above a 46,000 marker I have for the Bulls, and so far in an overall 11 week consolidation after a massive run up.

SRP Swing service continues to tee up new opportunities while closing out CRCT, GRBK this past week for gains.

This week charts updated on SP 500, Small Caps, Bitcoin, and Biotech.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. Just closed out 4 positions last few weeks and looking to add new positions over next several weeks.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised.

CELH- Coming out of a 13 week base last week, 3rd week in a row on the list, looks ready to break out soon. Develops and markets functional calorie-burning fitness beverages under the Celsius brand in U.S.

CLF- 5 weeks tight base on top of 14 week base, breaking out. A play on the Infrastructure spending. Producer of flat-rolled steel and supplier of iron ore pellets in North America.

RILY- 3 weeks tight base at highs. Provides investment banking, institutional brokerage and wealth

management services.

INMD- 3 weeks tight near highs. Has been on list often last few months, keeps moving higher. sraeli seller of radio frequency devices used in minimally & non-invasive cosmetic procedure/women’s health.

COWN- 8 week base near highs. Provides research, institutional brokerage and investment banking

services to foreign/domestic corporations

GRBK- 4 weeks tight base near highs. Owns, develops and sells land and builds single-family homes in

Dallas and Atlanta markets

UFPI- 4 week ascending base near highs. Manufactures lumber, composite wood and other building products

for the retail, construction

MDC- 8 week base near highs. Builds single-family detached homes for fi rst-time and fi rst-time

move-up home buyers

PPD- 3 weeks tight base at highs. Provider of drug development, laboratory svcs to pharmaceutical,

biotechnology and government organizations.

AZEK- 3 week ascending base near highs breakout amidst overall 12 week base. Designs and manufacturers low-maintenance residential and commercial building products.

CMBM- 4 weeks tight near highs. Provides wireless broadband networking infrastructure solutions for

network operators

LOVE – 4 week tight base, looks close to break out. Manufactures and sells foam fi lled furniture, sectional couches,

and related accessories.

JEF- 3 weeks tight base close to breakout within 12 week overall base. Engaged in investment banking, capital markets, asset management and direct investing business.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)