25 Apr Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of April 26th 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

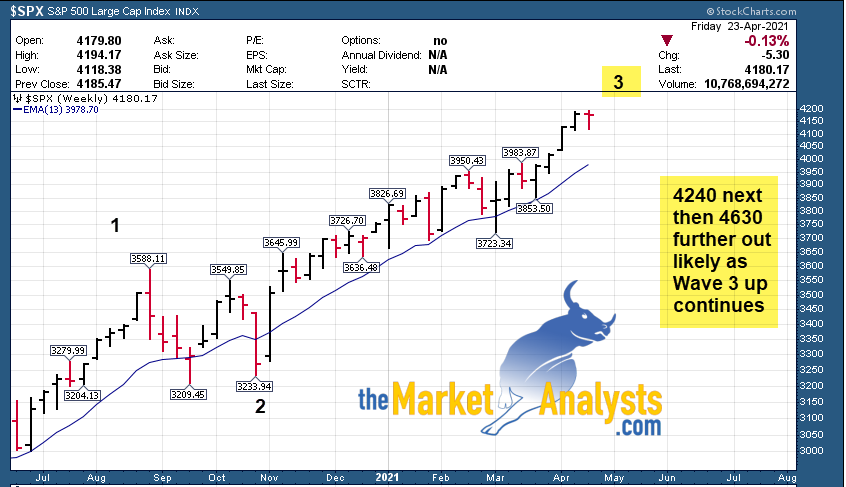

- 4240 next up for SP 500 and 4600 area over next several months possible (Chart)

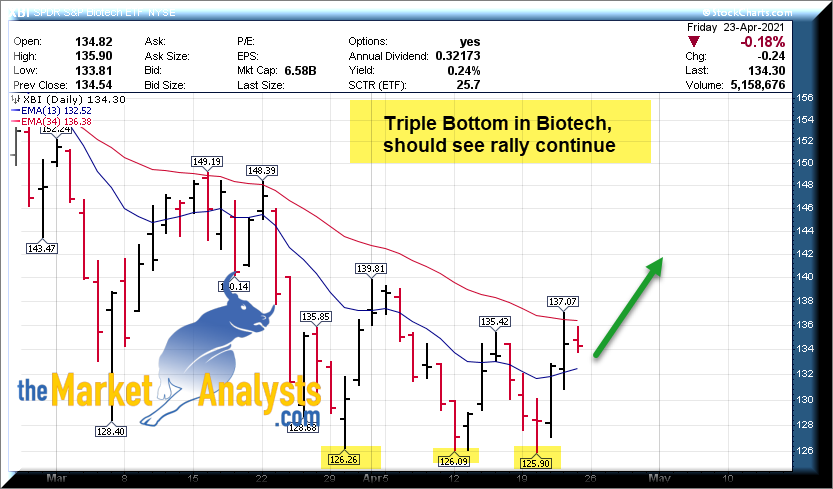

- Biotech triple bottom as sector moving up out of bear cycle (Chart)

- IWM ETF also in a consolidation over 11 weeks, likely breaks out within a few weeks (Chart)

- Bitcoin hit my 65,000 target and corrected. 46,000 key support (Chart)

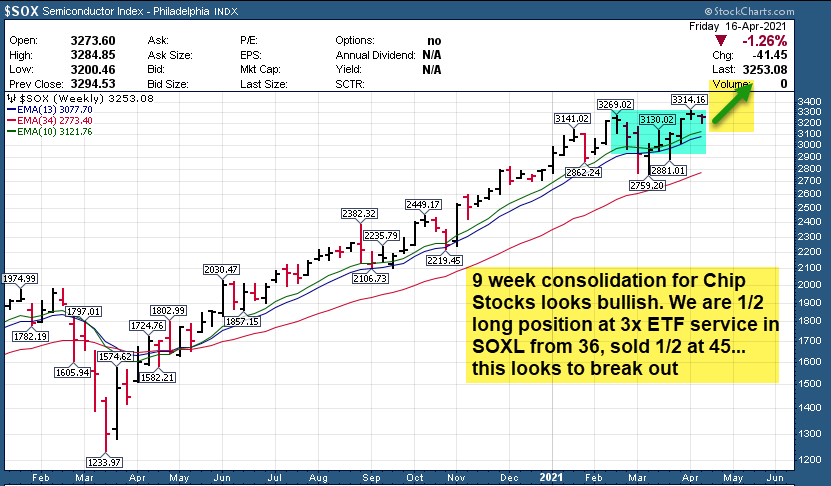

Recent results: 3x ETF service closed SOXL for 10% gains on final 1/2, made 25% on front half. We are long FAS and LIT both in the green, added TQQQ late in week. SRP alerted 3 new trades during week, all are in our favor. Futures service is long again and in the green after some huge gains recently.

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

SP should test 4240 soon on the upside and 4600 area in next quarter or two. Small caps bottoming out as noted last week and are going to break out in next few weeks. Also we saw a huge pullback in Bitcoin from the 65,000 target I put out awhile back. 46,000 is key initial support, we have been in the 47,000 ranges already and now 49,000 area as of this report. Biotech also moving up out of triple bottom and its a good time to be pushing capital into these recent bear cycle lows in Small Caps and Biotech. TPS service recommended 5 stocks early last week to push money into aggressively while closing out 3 positions, one for 70% gains on the final 2/3, we made 125% on the front 1/3 of that position. One of the 5 stocks is up 70% just this past week in terms of the ones I recommended to add to or buy, another is up over 40%… this is why you need to consider being a member of TPS in addition to SRP swing trading in my opinion. Long term big upside plays with active movement and advice etc.

This week charts updated on SP 500, Small Caps, Bitcoin, and Biotech.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020, last week one of our positions up 70% in 4 days from where I said to buy/add. Another up 45%. Attack capital paying of out of bear cycles.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised.

CELH- Coming out of a 13 week base last week, looks ready to break out soon. Develops and markets functional calorie-burning fitness beverages under the Celsius brand in U.S.

ATKR- Broke to upside out of prior 6 week tight base near highs. Has been on list for a few weeks. Manufactures electrical and mechanical products for the nonresidential construction and industrial markets.

QFIN- Moved to upside last week out of a prior 10 week overall base, sloppy and volatile but could be a mover in time. We got long late in the week at SRP for a swing. Chinese company’s data-driven tech platform helps financial institutions target products to consumers.

CLF- 4 week base on top of 14 week base, breaking out. A play on the Infrastructure spending. Producer of flat-rolled steel and supplier of iron ore pellets in North America.

LOVE – 3 week tight base, looks close to break out. Manufactures and sells foam fi lled furniture, sectional couches,

and related accessories.

COWN- 7 week base near highs. Provides research, institutional brokerage and investment banking

services to foreign/domestic corporations

PGNY- 2 weeks tight after near big breakout. Could start new bull leg. Provides fertility and family building benefi ts solutions in the United States for 2.7 mil members

TPX- 6 week base near highs. Makes temperature sensitive visco-elastic pressure foam mattresses, pillows, and comfort/lumbar cushions

HZNP- 11 week tight flat base near highs. Ireland based company develops therapeutics for the treatment of

rare and rheumatic diseases

ASO- 3 weeks tight base near highs. Operates 259 stores across 16 contiguous states, primarily in the

southern United States

SGH- 3 weeks tight near highs. Designs, manufactures, and supplies electronic subsystems to OEMs

engaged in computer

YETI- 2 weeks tight base after breakout to highs. Designs, manufactures and marketing innovative and outstanding

outdoor products

DT- 12 week overall base testing 10 week EMA not far off highs. Develops software intelligence platform to allow customers to modernize and automate IT operations

ZIM- 3 week ascending base at highs. Israel-based asset-light container liner shipping co provides cargo

solutions for all industries

CMBM- 3 weeks tight near highs. Provides wireless broadband networking infrastructure solutions for

network operators

JEF- 11 week overall base, but holding 10 week EMA line. Engaged in investment banking, capital markets, asset management and direct investing business.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

We hit my 4175 target on the SP 500 this past week on Friday, 4240 is up next for resistance. The large cap index is a bit extended here short term, watch 4240 as near term resistance. The next area of upside is micro caps and biotech ahead if I’m right from a risk reward. You may also see more money pouring into post Covid plays like Cruise Ships, Entertainment, Airlines ,Travel, Hotels etc going forward.

Last week I noted Biotech may try to double bottom and the XBI chart showed 126 area shaded, we hit that this past week. We took a long LABU position at 63-64 at 3x ETF service (Just $40 a month) and sold out at 70 short term, but we may re-enter soon, just want to see follow on confirmation.

Lots of charts today, Biotech, SP 500, SOX (Chips), and Small Caps (IWM)

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020, 2 new positions out recently with 4-5x plus potential if I’m right.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised.

VICI- 7 week base near highs. REIT that owns, acquires and develops experiential real estate

assets across gaming, hospitality and others.

CCS- 10 week base near highs and moving up last week, has been on my list 3 weeks in a row. Builds single-family detached and attached homes in metropolitan markets in Colorado, Texas, Georgia/Nevada

LOVE – 2 week tight base, looks close to break out. Manufactures and sells foam fi lled furniture, sectional couches,

and related accessories.

QFIN- 10 week overall base, sloppy and volatile but could be a mover in time. Would like to see this hold $21. Chinese company’s data-driven tech platform helps financial institutions target products to consumers.

ATKR- 6 week tight base near highs. Manufactures electrical and mechanical products for the nonresidential construction and industrial markets.

GRBK- 5.5 month base, now breaking out, SRP is long from a week ago. Owns, develops and sells land and builds single-family homes in Dallas and Atlanta markets, TX/Atlanta, GA (SRP Open Position)

CLF- 3 week base on top of 14 week base, breaking out. A play on the Infrastructure spending. Producer of flat-rolled steel and supplier of iron ore pellets in North America.

TPX- 5 week base near highs. Makes temperature sensitive visco-elastic pressure foam mattresses, pillows, and comfort/lumbar cushions

JEF- 10 week overall base, but holding 10 week EMA line. Engaged in investment banking, capital markets, asset management and direct investing business.

CRCT- 3 week recent IPO, trending sideways to up. Provides connected machines, design apps, accessories and materials to built do-it-yourself goods.

SLQT- 9 week base near highs. Brokers insurance products and offers senior health, life and auto and

home insurance policies.

DT- 11 week overall base testing 10 week EMA not far off highs. Develops software intelligence platform to allow customers to modernize and automate IT operations

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 7 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)