05 Nov Weekly Trading Ideas and Market Report

Publishers of Stockreversals.com (Opt in Free)

Stockreversalspremium.com a Swing Trade and Advisory service

TippingPointStocks.com a Long Term growth stock advisory service, just launched October 4th 2017! Join now at Charter Member Rates!

If not yet a Stock Reversals Member, opt in free today to get our free reports and intra-week updates!

Another uptrend high for the markets as the SP 500 is approaching our 2608 target we laid out about five weeks or so ago here at SRP in our forecast models. We expect resistance at that level.

This week we update the charts on the SP 500, IWM ETF (Small Caps), and Biotech (XBI ETF and LABU ETF).

We also have about 16 names for a Swing Trade Candidates list, and 3 Post IPO base play ideas as well this week

SP 500 uptrend is in week 11, could see another two weeks of upside here:

IWM ETF Update: Small caps consolidating prior large gains:

Biotech Update: XBI and LABU ETF

Trading 3x ETF’s: LABU sample

We took a swing trade entry on 3x Bull LABU ETF this week at SRP on the 31st with an Alert. We felt that after XBI had bounced up in a 50% re-tracement of the prior downside correction, it would pullback one more time. We were correct and this allowed us to average into LABU from 72-78 areas. We used a $72 “Stop near market close” to protect our risk, but this never triggered and gave us the room to accumulate on the last dip.

When trading 3x ETF’s, we look at the underlying ETF (XBI) and then project the pattern out on XBI in this case, and then apply that mathematically to the 3x ETF, in this case LABU. Results you can see below, and we are looking for $87 area on LABU for a trade target.

XBI and LABU charts:

Market Notes:

The percentage of Bullish Advisor’s in Investment Advisor surveys is at 64% now vs only 14% for Bears. This is the highest reading we can remember ever seeing. This indicates extreme Bullish views and therefore higher risk of a significant correction like the 2015 to early 2016 Primary 4 correction that took 28% off the Small Cap Index. Will it happen again? Well this is only one indicator but should be paid attention to.

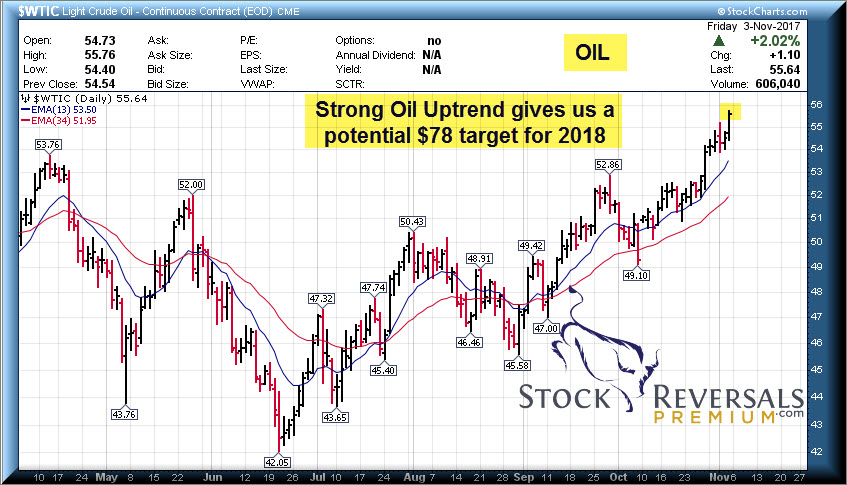

Oil is breaking out after a few years of basing, we can see a $78 target in 2018 per our forecast notes this week

Weekly Trade Ideas list:

This week 16 names with notes and 3 Post IPO base plays.

We like to have a list to start each week to work off of and often take 1-2 names and alert them after we drill down and do the work on both the patterns and the fundamentals for SRP Members.

3 Post IPO base plays :

JAG- Often on our list here of late, Jagged Peak Energy is breaking out now off a 9 month base.

DESP- On the list lately, in a corrective post IPO base. 7 week pattern, Argentinian/Latin American travel

CARG- 4 week ascending base for Car Dealer network

Swing Trade Ideas: 15 Swing Ideas with notes

HQY- One of our favorite long term growth names. Coming out of a 21 week base pattern, provider of Health Savings Account services (HSA). 31% growth, earnings already reported

MNST- Monster Energy has earnings due this week and could break out

YY- 6 week base near the highs for this Chinese Online Communications company, PE 16, Earnings due 11/20

AMAT- 3 weeks tight pattern near the highs. PE 19 for Chip Equipment King, earnings due 11/20

BABA- We have been recommending since $90, 8 week base here near the highs for Alibaba

COHR- 26 week base, PE 25, Laser and Optics instruments maker, earnings due 11/7

SUPV- 3 weeks tight pattern, Argentinian Bank, PE 16, Earnings due 11/9

FIVE- Five Below retail stores sell items at $5 or less. 6 week base pattern near highs, earnings due 11/29

PRAH- 4 week base, PE 28, 38% recent growth rates. Outsourced clinical services for Biotech industry

GTN- 4 week base pattern on top of overall 8 month base. TV stations/Broadcaster PE 8, earnings due 11/6

PLNT- 7 week base, we have profiled Planet Fitness since 19. 1300 fitness centers, EPS Due 11/7

TTD- 5 week base, we first wrote up The Trade Desk at $29 post IPO. The leader in digital advertising and more, allowing buyers to program ad buying. Earnings due 11/9

BGCP- Pullback to the 10 week line, Global Brokerage company

FB- Facebook in yet another bullish base, this one a 15 week base that should break out soon

GDOT- 5 week ascending base for this provider of re-loadable Debit Cards, PE 29, Earnings due 11/7

SRP Update:

This past week we saw our LABU position rally hard into the end of the week (3x Bull Biotech ETF). Also we took nice profits on SEDG of over 16% and MLCO of 10% gains each.

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analyst)

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com